Trading

Boosting dollar returns during euro strength

To boost returns on a US dollar deposit in a bullish euro environment, a European exporter would be wise to consider an FX tarn with conversion, says Christophe Bouculat, senior FX structurer at Calyon in Paris

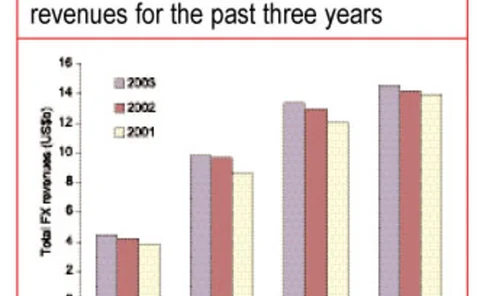

Year of plenty for top 30 banks

Little evidence of mid-tier contraction as revenue ranking hits new high

Micex expands forex coverage

MOSCOW – The Moscow Interbank Currency Exchange (Micex) has launched new FX contracts in a step towards expanding the exchange-traded FX market in Russia.

Forex firm fined record $100m for fraud

NEW YORK – A US federal court ruled in favour of the Commodity Futures Trading Commission (CFTC) last week, as it found a foreign exchange futures firm liable for the illegal sale of futures contracts. The $100 million restitution and penalty charges…

Yen volatility returns in MoF absence

TOKYO – Traders in Japan are reporting a healthy return to yen volatility following the Japanese Ministry of Finance's (MoF) withdrawal from currency intervention in mid March.

Consensus forecasts win out

Consensus forecasts are commonly seen as a reliable indicator of future currency moves, and our Currency Forecasts Index proves this – to a degree.

Kiwi ripens against Aussie

The New Zealand dollar is rising against the Aussie in line with interest rate differentials. But potential growth in Australia may cap its gains, says Sue Trinh, currency strategist at the Bank of New Zealand in Wellington

Overlay staff in short supply

NEW YORK – Demand for currency overlay is outstripping the supply of available managers, as the boom in investors managing currency continues.

Election uncertainty hits Phillippine peso trading

MANILA – Market participants in the Philippines are anticipating a return to volatility in the next few weeks, as uncertainty over the recent elections clears up.

Swissie rise snares forecasters

Dollar/Swiss was the most difficult currency pair to forecast over the past month, as the Swissie's 5% rise against the greenback took it from 1.3019 on May 7 to 1.2370 on June 7. Average % accuracy on one-month forecasts submitted by the 38 banks on our…

Improver knock-in forward for dollar bears

With the widely held belief that dollar/yen has scope to fall much further, Royal Bank of Canada's financial engineering team in London proposes a solution for a client wanting to buy US dollar forwards at more attractive rates. An 'improver knock-in…

An obsession with oil

Swiss franc, Norwegian krone and euro gains may be about to reverse, says Steven Pearson, chief currency strategist at HBOS Treasury Services in London

Snow hails CME's China deal

CHICAGO – The Chicago Mercantile Exchange (CME) has forged a ground- breaking deal with a central bank-sponsored FX trading platform in China, in a move hailed by US government officials as a crucial step towards renminbi flexibility.

Reuters sees sales turnaround

LONDON – Reuters chief executive Tom Glocer last week announced the first positive month for sales since May 2001. Speaking at an investor's conference in London, Glocer said sales of the vendor's data and technology products in May 2004 exceeded…

Saxo upgrades support service

COPENHAGEN – Saxo Bank has upgraded support for users of its white-label trading platform SaxoTrader, with a new service to offer advice on website development, advertising, marketing and customer relationship management.

Citigroup restaffs Singapore sales

SINGAPORE – Citigroup has rehired to fill a void in its Singapore institutional sales team after a team of three defected to Barclays Capital.

EBS launches Aussie and Canadian trading packages

LONDON – Spot broker EBS last week launched new Australian and Canadian dollar packages for its dealing platform in a bid to increase market-share in those currencies.

Brokers react to shrinking market

LONDON – As the dust settles on the news of Collins Stewart Tullett's (CST) imminent takeover of Prebon Yamane, rival brokers are upbeat about their prospects arising from the £135 million deal. The combination of two of the six major broking firms in FX…

Japan's MoF steers clear of intervention

TOKYO – Japan's Ministry of Finance (MoF) last week revealed it has not intervened in the FX markets since mid-March – and is likely to refrain from further currency intervention for some time, said market participants.

Volatility troubles traders

High intra-day volatility is making life difficult for forex traders, says Shahab Jalinoos, senior FX strategist at ABN Amro in London

RBS is top 12m forecaster

Forecasting currency moves over a 12-month horizon is a difficult discipline. In addition to negotiating unexpected economic data, interest rate differentials and trader psychology, the successful forecaster must also contend with geopolitical risks - a…

Long-term solution for dollar/rupee liability

With the Indian rupee rising and a low federal funds rate, Amit Bansal, head of treasury at Barclays Capital in Mumbai, proposes a solution for a corporate to take advantage of the inverted swap points

ACI Congress debates future

LONDON – The European forex community gathered in London last week for the ACI European Congress hosted by ACI UK. Among the contentious issues discussed during the three-day event were operational risk, the future of the European Union and trading in…

Oil troubles yen forecasting

Yen was the most troublesome currency to forecast throughout May, as the soaring cost of oil hit oil consumer Japan’s unit – and with it, yen forecasting accuracy.