Trading

Will payrolls break EUR/USD range?

The market is already shifting its focus to this week's payrolls release, but the case for a range break in euro/dollar from a large positive or negative surprise is not clear cut, says Trevor Dinmore, FX strategist at Deutsche Bank in London

FX volumes up by a third

LONDON – FX trading volumes are up by nearly a third over the past three years, according to new research from UK consultancy ClientKnowledge.

Calyon picks the dollar recovery

The current broad dollar recovery, which saw euro/dollar dropping three big figures and sterling/dollar sinking by nearly five in just two weeks, has caught out many in the FX market. But Calyon was not at all surprised, explained Mitul Kotecha, global…

New hedging policy adds $35m fizz to Fosters

MELBOURNE – Australian brewer Fosters Group added nearly US$35 million to its operating profits after changing its FX policy this year in response to upcoming accounting standard IAS 39.

Commerce FX storms US retail market

BOSTON – Commerce FX, a subsidiary of Boston-based Commerce Bank & Trust, is reaping the rewards of its entrance into the retail margin trading market last year, an official told FX Week .

PHP trading volumes surge in "fiscal crisis"

MANILA – Traders in Manila are seeing soaring volumes in Philippine peso trading, after the country's president said it was in the midst of a fiscal crisis last week.

Eliminating foreign exchange translation risk

FX translation can mis-represent a company's profit growth on its balance sheet. Cliff Bayne, senior exotics dealer, and Terence Yiu, chief dealer, at ABN Amro in Singapore, explain how to hedge the translation risk at minimal cost

CSAM to add emerging markets to FX management

LONDON – Credit Suisse Asset Management (CSAM) is looking to add emerging market currencies to its suite of forex management services from early next year.

Dollar/yen break-out expected

TOKYO – Technical indicators suggest dollar/yen could be set to break out of the tight trading range it has been trapped in since June. "Resistance is declining and support is rising. We will get a decent break-out trade soon," said Karen Griffith, head…

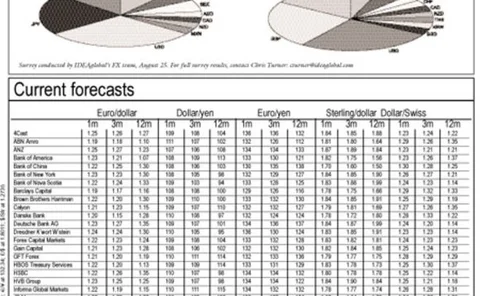

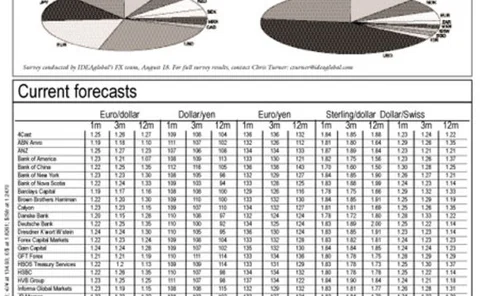

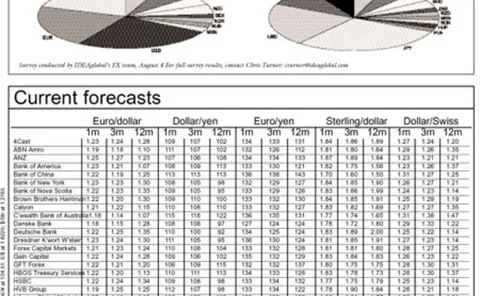

August trading floors forecasters

August may be providing plenty of opportunities for traders, as sharp moves slice through the seasonally thin markets. But the price volatility is creating havoc for FX forecasters in the unpredictable environment, according to the FX Week Currency…

China eases restrictions on capital account

BEIJING – The Chinese government made further steps towards liberalising the capital account last Wednesday by allowing insurance companies to invest 80% of foreign exchange assets overseas.

Is yen decoupling from oil?

The yen's gains against the greenback last week suggest an apparent decoupling from oil says Neil Mellor, currency strategist at Bank of New York in London

Hedging when the market moves against you

A nine month sliding forward structure can help your company achieve attractive FX hedging rates when the market has moved substantially beyond your budget rates, says Adam Gilmour, head of FX options sales in Citigroup's emerging markets sales and…

Return of the voice broker

Cantor Fitzgerald revives voice broking market with spin-off firm. NEW YORK - Cantor Fitzgerald reversed a trend of consolidation in the broking market last week by spinning off a new firm to focus exclusively on voice broking.

CSFB gets OK for derivatives in China

HONG KONG – The China Banking Regulatory Commission (CBRC) authorised Credit Suisse First Boston (CSFB) to launch a financial derivatives business in China last week.

Rate differentials bolster peso trading

MEXICO CITY – Speculation on the direction of US interest rates is bolstering already high levels of trading in US dollar/Mexican peso.

Yen accuracy slips in static month

Forecasting moves in the yen pairs has caused trouble for contributors to the FX Week Currency Forecasts Index over the past month.

Euro/sterling kicks off

The summer football transfer season is providing unexpected support for euro/sterling, writes Pete Luxton, global markets adviser at Informa Global Markets in London

Oil price hits Asian currencies

HONG KONG – Surging oil prices have put pressure on Asian currencies, but the impact has been magnified by other factors influencing the region, according to analysts.

Russian peg change to drive rouble trading

MOSCOW – A touted move from a dollar peg to a dollar-euro basket will be the key driver for trading in the rouble in coming months.

Toyota reports ¥70bn FX impact

TOKYO – Japanese car manufacturer Toyota Motor Corporation last week announced a ¥70 billion ($645 million) hit from exchange rate changes affecting its first quarter operating income.

Forward structure for an exotics-shy corporate

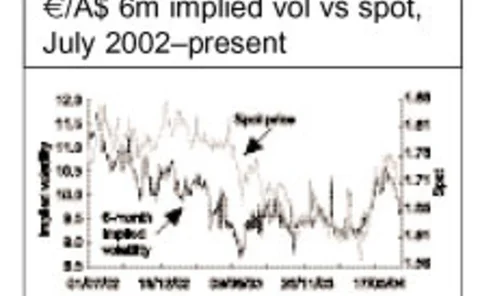

High price volatility is making EUR/AUD exposure challenging to manage. Sara Sullivan, ANZ’s senior FX options sales manager in London, proposes a solution for a European multinational that receives payments from an Australian subsidiary

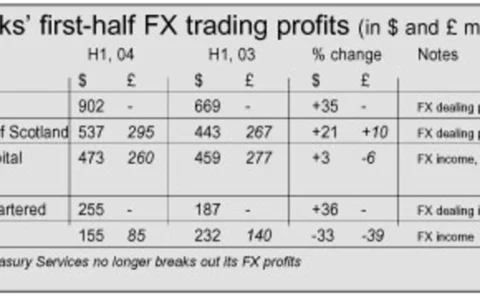

HSBC’s profits up by a third

LONDON – HSBC’s FX profits so far this year are up by more than a third compared with last year, with a massive $902 million earned from FX dealing in the first half.

Currency transfers for multiple entities

Straight-through processing FX for intra-company transfers used to be impossible. Royal Bank of Scotland’s Stamos Fokianos explains how this can now be done via RBS FiX