Trading

FX policy has worked, says RBA

CANBERRA – The Reserve Bank of Australia (RBA) has succeeded in its aim of stabilising the Australian dollar through intervention in the currency markets, it said last week.

Asian currencies bounce back after price hit

HONG KONG – Asian currencies have bounced back after taking a hit from the high price of raw materials, particularly oil, in recent weeks.

Ringgit revaluation looms

A change in the Malaysian ringgit's peg to the dollar is likely, despite the Malaysian authorities' protestations that this will not happen, says David Mann, Standard Chartered's senior FX strategist in London

HSBC launches charting package on FXall

LONDON – HSBC has launched a free online FX charting package on multi-bank portal FXall's website, covering 15 major cross rates. The service, fxcharting@hsbc, is white-labelled from UK-based charting provider TraderMade.

Non-bank players take the lead

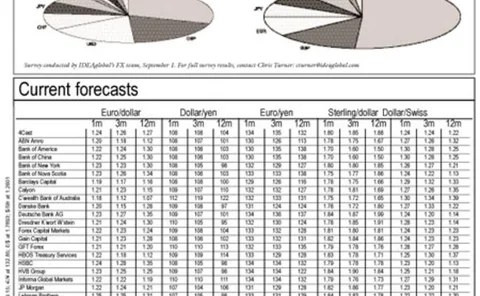

Analysts at banks are lagging behind in FX forecasting, according to the Currency Forecasts Index. Trading firms are in both top spots on the year-to-date index, while research firm 4Cast is this week's best three-month forecaster.

Sun Platinum pays $40 million penalty

WASHINGTON – FX trading firm Sun Platinum was last week ordered to pay $40 million in civil penalties and restitution to customers, after a US district court entered a default judgment against the firm.

Buy side to see Matching prices

LONDON – Fund managers, corporates, and mid-tier banks will soon get access to Reuters' interbank FX rates for the first time, the UK vendor will announce today (September 13).

Former Soviet satellites' FX interest increasing

ASTANA, KAZAKHSTAN – The FX market for the states surrounding Russia has picked up in recent years due to liberalisation of capital and increasing international trade.

The perils of a presidential election

The forthcoming US race for the White House represents a major risk for the FX markets ahead of voting in November and beyond, says Bilal Hafeez, head of foreign exchange strategy at Deutsche Bank in London

4Cast buys SocGen's directory and website

LONDON – 4Cast has bought the Dealers Directory from Société Générale, the French bank said.

Pound holds up against dollar and euro

Cable has seen significant volatility over the past three months, according to the FX Week Currency Forecasts Index. Sterling peaked at 1.8771 on July 19, with a low of 1.7709 on September 8.

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

FXall adds five price-makers

NEW YORK – Five banks have signed up to provide prices to multi-bank platform FXall, the firm said last week.

Calyon to outsource liquidity

PARIS – Calyon is in discussions with other un-named banks to outsource currency trading to them.

NAB to re-open options desk

MELBOURNE – National Australia Bank hopes to re-open its currency options desk in the "near-term", said chairman Graham Kraehe last week. However, the bank refused to be drawn on a date, saying it was up to regulator the Australian Prudential Regulation…

South Africa comes under global focus

JOHANNESBURG – South Africa is currently a focus of activity in the FX world, as global institutions such as the Continuous-Linked Settlement Group (CLS) and spot broker EBS add the region to their sphere of activity.

UBS sees euro at $1.40 in a year

Apart from a brief dip below 1.20 in mid-May, euro/dollar has been bouncing between 1.20 and 1.25 per dollar since the end of February – a period of relative price stability for the pair, which rose a massive 20 big figures in the preceding six months.

How spreads can affect profitability

Spread cost makes a big impact on profitability, says Michael Stumm, co-founder and president of Oanda. Here he shows how to assess just how much different levels of spreads cost

Will payrolls break EUR/USD range?

The market is already shifting its focus to this week's payrolls release, but the case for a range break in euro/dollar from a large positive or negative surprise is not clear cut, says Trevor Dinmore, FX strategist at Deutsche Bank in London

Politics fail to dampen hopes for forint

BUDAPEST – The resignation last month of Hungary's prime minister Peter Medgyessy has not led to the trading opportunities that may have been expected from the country's currency, the forint.

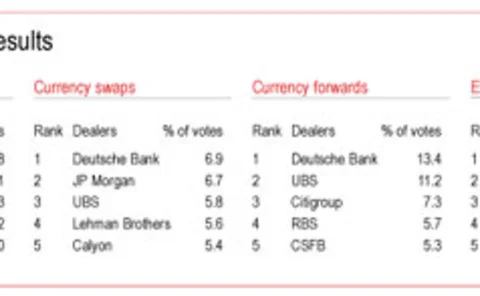

Rankings reveal diversifying inter-dealer market

The inter-dealer market for foreign exchange is shrinking, as an increasing number of mid-tier players retreat from market-making to become clients of the top firms. The banks that remain are working hard to consolidate their positions as liquidity…

EBS to admit funds to Spot

LONDON – Spot broker EBS will allow funds to trade on its EBS Spot platform from next year, it will announce this week.

Pension funds scramble for FX management

LONDON – UK pension funds' demand for foreign exchange management has gone through the roof over the past year, as trustees and managers seek to limit risk and improve returns.

Foley to launch Gelber FX desk

CHICAGO – Bank One's former forex options chief Justin Foley is joining Gelber Trading, a division of Chicago-based trading firm Gelber Group, to set up a new FX desk in September.