Trading

No ringgit peg change

KUALA LUMPUR -- New FX regulations introduced in Malaysia on April 1 may herald further economic liberalisation, but that does not mean the ringgit’s peg to the US dollar will be relaxed soon, analysts in Asia told FX Week .

CS steps into fifth place for forex revenues

ZURICH -- Credit Suisse Group published its FX trading results last week, taking the bank to fifth position in FX Week ’s yearly revenues ranking, based on banks’ announced results so far this year.

The zero-cost double KO/KI forward

A double knock-out/knock-in forward may provide a Mexican manufacturer with an effective zero-cost hedge, say Vincent Lee and Richard Stang, vice-presidents in FX sales at TD Securities in Toronto

Banks unclear on new research rules

LONDON -- The UK’s FX Joint Standing Committee is to host a meeting with UK regulator the Financial Services Authority (FSA) to clarify the forex implications of FSA rules on research that were released last week.

Travelex to buy Fortis FX unit

TORONTO -- FX services group Travelex has reached an agreement to buy Fortis’ Dutch corporate and retail FX subsidiary GWK Bank for e17.5 million, the firm announced last week.

HSBC reaps rewards in US

NEW YORK -- HSBC has seen a threefold increase in FX client volume in North America over the past year, following its recruitment drive in the region. And gains made in the first quarter of 2004 suggest it is continuing to build that volume "at a very…

NZ ups reserves as "insurance"

WELLINGTON -- The Reserve Bank of New Zealand (RBNZ) is proposing to enhance its capacity to intervene in FX markets. The central bank wants to increase the amount of foreign currency reserves it holds as "insurance" against a non-convertible Kiwi dollar…

Watchdog savages NAB

MELBOURNE -- National Australia Bank’s currency options desk will remain closed until it has satisfied requirements issued by its regulator in a damning report released last week.

Calyon names regional managers

PARIS -- Calyon, the group to be formed from the merger of Crédit Agricole Indosuez (CAI) and Crédit Lyonnais (CL) on April 30, has agreed the structure of its global spot FX business and appointed regional heads, a senior official said last week.

Aussie hits a high

The Aussie dollar looks set to be the one of the main beneficiaries from continued central bank currency intervention in Asia, argues Robert Rennie (right), chief currency analyst at Westpac in Sydney

Investment banks break records

NEW YORK -- This year looks set to be a record-breaker for banks' FX earnings, if the commercial banks follow the lead set by the US investment houses.

NAB OPTIONS SCANDAL - NAB crisis deepens with latest departure

MELBOURNE -- The staffing crisis at National Australia Bank (NAB) deepened last week as Peter Cunningham, joint global head of FX left the bank, in a move a NAB spokesperson described as a "mutual agreement".

Seven leave Dresdner in FX flight

LONDON -- Dresdner Kleinwort Wasserstein in London is facing an exodus of staff from foreign exchange, with at least seven leaving the bank in London and New York in the past month.

EBS sees fruit of 'sustained effort on sterling'

LONDON -- Spot broker EBS last week quantified the success of its initiative to build sterling volumes on its platform.

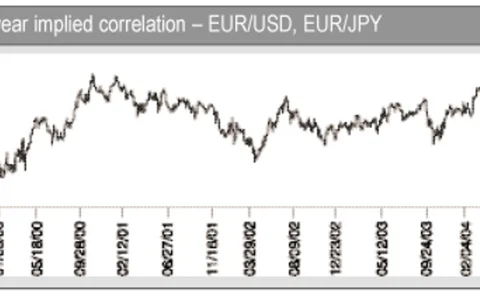

Are long-dated options correctly priced?

Options pricing is based on a flawed model of market efficiency. This is why market-makers and hedgers might see the same volatility as cheap or expensive, depending on their viewpoint, says Gilles Bransbourg, head of European FX sales at Bear Stearns in…

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Banks add NDFs to e-trading tools

LONDON -- Royal Bank of Scotland, Barclays Capital and Standard Chartered are planning to launch electronic trading of non-deliverable forwards (NDFs) this year, chasing market leaders in the field such as Dresdner Kleinwort Wasserstein and Deutsche Bank.

NAB report: managers axed

FX head and three executives leave NAB in wake of report on forex losses MELBOURNE -- National Australia Bank (NAB) sacked head of FX Gary Dillon on Friday (March 12) after he was criticised by PricewaterhouseCoopers’ independent report into the bank’s A…