Trading

Cancellable forward beats dollar pendulum

Cancellable forward contracts offer corporates a cheap way of protecting against volatile dollar receivables says Anders Kjaer Jensen, FX strategist at Nordea in Copenhagen

FX is platform for growth at Merrill

NEW YORK -- Merrill Lynch’s investment in foreign exchange will form a platform for growth for the US investment bank, said chairman and chief executive Stanley O’Neal last week.

Volatility plays havoc with cross-border M&A

LONDON -- Foreign exchange volatility might be offering traders unprecedented opportunities in the currency markets -- but sales dealers are paying for it with the loss of cross-border mergers and acquisitions (M&A) business.

800 expected at ACI London event in May

LONDON -- Forex industry body ACI is expecting up to 800 FX officials to descend on London in May for its seventh European Congress, hosted by ACI UK.

Portfolio flows and the dollar’s outlook

The pace of the dollar’s decline appears to have returned to more sustainable levels, says Michael Woolfolk, senior currency strategist at The Bank of New York

Asian regulators ease restrictions

HONG KONG -- Banks in Northeast Asia are rushing to apply for licences to enable them to transact non-renminbi derivatives in China, following a relaxation of the rules from March 1.

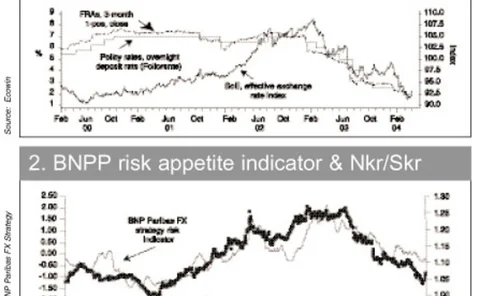

Falling rates spell kroner/krona opportunities

The Norwegian kroner is being supported by oil prices and carry-trade liquidation, but these factors will force the Norges Bank to slash rates. This provides the opportunity for short-term tactical trades against the Swedish krona, says Hans-Guenter…

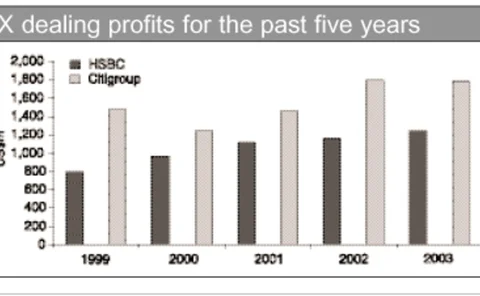

Loewy exits on a high note

HSBC’s FX chief retires as the bank makes highest-ever forex profits LONDON -- Rob Loewy, head of FX at HSBC for the past 15 years, retired last Monday (March 1) as the bank announced its highest-ever dealing profits for foreign exchange.

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

Gartmore leads new hedge fund launches

LONDON -- Gartmore Investment Management has added to the recent explosion in currency funds with the launch of a new hedge fund. The fund, available to institutional investors around the world, builds on the firm’s 16-year track record in currency…

Busy start to year sets records on EBS

LONDON -- The start of 2004 has proved to be the busiest in the past 10 years, according to spot broker EBS.

HBOS profits up 10% on corporate growth

EDINBURGH -- HBOS Treasury Services had a successful year in forex, with FX profits rising by about 10% year-on-year for 2003, a senior official told FX Week .

Rotation in reflation trades

Inflation is driving the UK to raise interest rates while other nations are set to cut rates to drive growth. These rate differentials provide opportunities for return says Monica Fan, head of European FX strategy at RBC Capital Markets in London

Correlation for hedging and speculation

One of the most surprising FX developments in the past year has been the re-emergence of the use of correlation products. Ade Odunsi, a director in Merrill Lynch’s FX risk advisory group in New York, suggests two such solutions for a hedging and a…

FXI launches managed trading for institutions

FARMINGVILLE, NY -- Online currency trading firm FXI Corporation is launching an Institutional Trading Services (ITS) division in response to growing demand for managed trading accounts from hedge funds and asset managers, an official said last week.

Emerging FX takes off online

LONDON -- Increasing demand from both corporate and hedge fund clients for the ability to trade emerging markets (EM) currencies online is leading banks to boost their e-trading offerings in this area, senior officials told FX Week .

Near-term ringgit peg change unlikely

KUALA LUMPUR -- Despite recent reported comments from Malaysia’s second finance minister, Tan Sri Nor Mohamed Yakcop, Malaysia is unlikely to change the ringgit’s current peg to the US dollar -- at least until the country’s general election is over.

FX smashes $600m hole in Anglo accounts

LONDON -- The cost of failing to hedge FX risk was brought into sharp focus last week, when mining firm Anglo American said its 2003 earnings were down nearly $600 million as a result of currency movements.

Hedging dollar dividends back to euro

A European company seeking to protect dividends received from a US subsidiary can benefit from the current inverted volatility term structure in the FX options market. UBS’s FX Solutions group explains how