Market voice

Asset sales support baht and rupiah

A wave of asset sales and privatisation in Indonesia and Thailand looks set to strengthen the Indonesian rupiah and Thai baht, says Irene Cheung (right), Asian sovereign and FX strategist at ABN Amro in Singapore

Fed reserved

For all its talk of deflation, the Fed fails to walk the walk, says Alan Ruskin, research director at 4Cast in New York

Dollar and US stocks decouple

The positive correlation between US stocks and the dollar has seen a turnaround, and this is unlikely to reappear in the near future, says Niels Christensen, senior currency strategist at SG in Paris

Cause and FX

Corporate hedging practices have become a focal point for equity investors, as companies look beyond traditional risks. Alex Patelis, senior G-10 FX strategist at Merrill Lynch in London, highlights the risks to balance sheets from capital losses on…

Is the dollar bouncing back?

The US dollar may have been mired in decline in recent months, but a recovery could be on the cards sooner than expected, says Tony Norfield, global head of FX strategy at ABN Amro in London

New Europe's FX trials

The convergence process of accession countries has been put into question. Currencies of those countries, and the Hungarian forint in particular, are likely to continue to be under pressure, say Mehmet Simsek (right) and Yianos Kontopoulos, FX…

Put the brakes on

European policymakers may have cause for concern if the recent euro rally continues, says Paul Meggyesi, senior currency strategist at JP Morgan Chase in London

A new crystal ball

Second-guessing the Federal Reserve is getting more complicated as the central bank enters uncharted territory, says Lara Rhame, FX economist at Brown Brothers Harriman in New York

Tale of two currencies

Recent FX market moves have exposed differing interest rate strategies for the eurozone and the UK, says Lorenzo Codogno (right), co-head of European economics at Bank of America in London

Appreciating the euro

With economic conditions in the eurozone worsening, the authorities are unlikely to allow the euro’s strengthening to continue, says Mitul Kotecha, global head of FX research at Credit Agricole Indosuez in London

You have the right to remain bullish

Indonesia’s currency has offered arresting yields, while the Singapore dollar is supported by its powerful monetary authority. Further gains in both are likely, say Standard Chartered’s Claudio Piron and Marios Maratheftis.

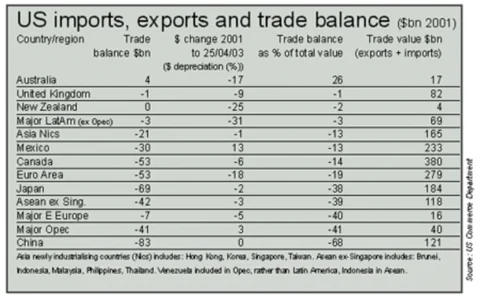

Falling dollar, limited external adjustment

Issues surrounding capital flows and surpluses could lead to some countries reconsidering their currency pegs, says Steven Englander (right), chief currency strategist, Americas, at Barclays Capital in New York

Cycles, structures and the dollar

It is difficult to ascertain what drives the capital markets at any one time. Market participants often seem to confuse cyclical and structural factors, and this is especially true of the dollar now, says Marc Chandler, chief currency strategist at HSBC…

Loonie zooms

Canadian dollar strength is set to continue, say Lauren Germain and David Mozina, of Bank of America’s FX strategy group in New York. And the market is reacting accordingly

When stocks rocket

Markets are expecting a post war rally in equities. Jesper Dannesboe, chief FX strategist at Dresdner Kleinwort Wasserstein in London, looks at the implications for FX

Dare to compete

The Canadian dollar has a chance to shine, but will domestic exporters seize the opportunity? asks Craig Larimer (right), managing director, international research group, Banc One Capital Markets in Chicago

The fog of war

What should you do when near-term uncertainties cloud the FX outlook? Concentrate on the medium term and rely on the fundamentals, say Yianos Kontopoulos (right) and Marcel Kasumovich, FX strategists at Merrill Lynch in New York

The fog of war

What should you do when near-term uncertainties cloud the FX outlook? Concentrate on the medium term and rely on the fundamentals, say Yianos Kontopoulos (right) and Marcel Kasumovich, FX strategists at Merrill Lynch in New York

War and the dollar

Near-term dollar direction will now depend on the length and ‘success’ of the war. But those factors are far from certain, says Jake Moore, FX strategist at Barclays Capital in Tokyo.

Sterling caught in the middle

The relationship between sterling/dollar and euro/dollar has broken down since the start of the year, resulting in sterling’s recent under-performance, says Lena Komileva (right), EMEA economist at Prebon Marshall Yamane in London.

After feast comes famine for the dollar

The US dollar may have been feasting on inflowing money in recent years but, says Pete Luxton, global economic adviser at MMS International in London, it is now going hungry

Bloc boosting

Rising commodity prices and high yields have boosted the ‘dollar bloc’ currencies, and the trend is set to continue, says David Mozina, head of G10 FX strategy at Banc of America Securities in New York

Trichet still best bet for ECB job

Jean-Claude Trichet’s trial is not an insurmountable obstacle to his accession to ECB presidency. But while the outcome is uncertain, French officials must come up with a back-up candidate, says Stephen Sandelius, Paris correspondent for Market News…

A focus on partnerships

Vision, transparency and communication are key to FX outsourcing partnerships, says Kiril Alexiev, assistant vice-president in Global FX Strategic Alliances at ABN Amro in Chicago