Market voice

Central bank financing down

Foreign central bank financing of the US trade deficit is now below 30%. This means the quality of financing of the US structural deficit continues to deteriorate and pressure to sell the dollar will intensify, says Chris Turner, senior partner for FX at…

Property pressures the pound

As UK property price growth slows, investors are moderating their view on the Bank of England tightening cycle. This could add to sterling weakness, says Adam Myers at SG CIB in London

Dollar set to depreciate

Net capital inflows will exceed the US current account deficit over the next year, prompting dollar depreciation to begin again, says Jay Bryson, economics analyst at Wachovia Bank in Charlotte, North Carolina

Kiwi ripens against Aussie

The New Zealand dollar is rising against the Aussie in line with interest rate differentials. But potential growth in Australia may cap its gains, says Sue Trinh, currency strategist at the Bank of New Zealand in Wellington

An obsession with oil

Swiss franc, Norwegian krone and euro gains may be about to reverse, says Steven Pearson, chief currency strategist at HBOS Treasury Services in London

Volatility troubles traders

High intra-day volatility is making life difficult for forex traders, says Shahab Jalinoos, senior FX strategist at ABN Amro in London

Election jitters

A tight presidential race could spell trouble ahead for the US dollar, says Peter Luxton (right) global markets adviser at Informa Global Markets in London

Terrorism threatens Turkish lira

Turkey’s proximity to the worsening situation in Iraq is prompting an outflow of capital and sending the lira spiralling downwards, says Neil Mellor, FX strategist at Bank of New York in London

China to stick with peg

While Chinese officials have hinted a yuan peg change may be imminent, Adrian Foster, FX strategist at Dresdner Kleinwort Wasserstein in Singapore sees change unlikely in 2004

What is oil telling us?

The high cost of oil in the US may hit the dollar hard in Q4, says John Taylor, chief investment officer at overlay manager FX Concepts in New York

Political upheaval nears the endgame

The next two to six weeks in Poland will be very important for the medium-term outlook of the Polish zloty and indeed the entire country, says Daniel Katzive, FX strategist at UBS in New York

RBI under scrutiny as rupee rises

A recent surge in the rupee is prompting debate about the Reserve Bank of India’s (RBI) forex policy, says Peter Redward at Deutsche Bank in Singapore

Cashing in on Asia

Asian FX offers abundant opportunities to make money over the next few months. Mike Newton (right), regional FX strategist, HSBC global markets in Hong Kong, suggests potential trade ideas to make the most of the markets

Japan: on the move

Japan’s economic rebound looks more and more like the long-awaited self-sustaining recovery that would put an end to the post-bubble era. But there are still big risks, says Anne Mills, head of foreign exchange research at Brown Brothers Harriman in New…

Why the US current account still matters

Is the market’s new-found obsession with portfolio flows data justified in assessing the US dollar? asks Adam Cole, senior FX strategist at Credit Agricole Indosuez in London

Aussie hits a high

The Aussie dollar looks set to be the one of the main beneficiaries from continued central bank currency intervention in Asia, argues Robert Rennie (right), chief currency analyst at Westpac in Sydney

Are long-dated options correctly priced?

Options pricing is based on a flawed model of market efficiency. This is why market-makers and hedgers might see the same volatility as cheap or expensive, depending on their viewpoint, says Gilles Bransbourg, head of European FX sales at Bear Stearns in…

Portfolio flows and the dollar’s outlook

The pace of the dollar’s decline appears to have returned to more sustainable levels, says Michael Woolfolk, senior currency strategist at The Bank of New York

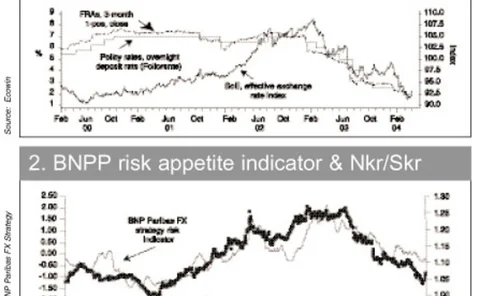

Falling rates spell kroner/krona opportunities

The Norwegian kroner is being supported by oil prices and carry-trade liquidation, but these factors will force the Norges Bank to slash rates. This provides the opportunity for short-term tactical trades against the Swedish krona, says Hans-Guenter…

Rotation in reflation trades

Inflation is driving the UK to raise interest rates while other nations are set to cut rates to drive growth. These rate differentials provide opportunities for return says Monica Fan, head of European FX strategy at RBC Capital Markets in London

Time for Asia to flex FX

A week after the Boca Raton G7 communiqué, and the market is flexing its capital muscle, prompting a broad appreciation of Asian currencies, writes Claudio Piron, head of FX strategy at Standard Chartered Bank in Singapore

End of the line for euro/dollar ascent?

The market may push euro/dollar higher to challenge the European Central Bank’s resolve, but economic fundamentals are stacking up against the euro, says Stephen Jen, currency economist at Morgan Stanley in London

Sterling -- a call for calm

The market has got so excited about sterling it has failed to recognise underlying economic problems in the UK. These problems will see sterling disappoint many in 2004, say David Bloom (left) and Mark Austin, currency strategists at HSBC in London

Mission impossible

Japanese FX intervention is increasing, but even unlimited funds would fail to stop appreciation, says Simon Derrick (right), head of currency research at the Bank of New York in London