Opinion/Technology

Traders’ perceptions of market timing

Jeffrey Todd Lins, director in quantitative analysis at Saxo Bank in Copenhagen, discusses the importance of timing in making trade decisions following an economic release

Cancellable forward beats dollar pendulum

Cancellable forward contracts offer corporates a cheap way of protecting against volatile dollar receivables says Anders Kjaer Jensen, FX strategist at Nordea in Copenhagen

Accrual strategy counters euro/dollar vol

The next phase of dollar weakness is unlikely to be as monotonous as the previous one. Dollar sellers should therefore use an accrual strategy to exploit market volatility, says Bart Wong, senior FX structurer at Barclays Capital in London

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

Assessing the value of e-FX trading

Predicting future currency movements is not the only problem currency managers face. Finding the best method of dealing is also an issue, explains Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency…

Euro/Swiss franc risk reversals

Simple risk reversals are the best way for Swiss investors to manage low domestic interest rates and a softening Swiss franc versus the euro, says David Durrant, chief currency strategist and senior economist for the Americas at Julius Baer Asset…

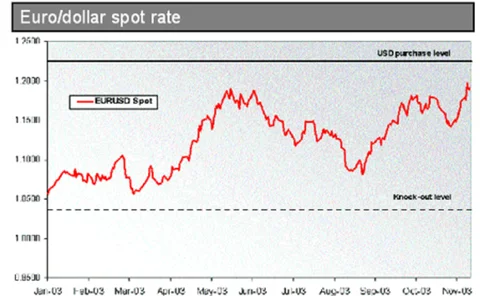

Soft Accumulator: improving hedging levels

BACKGROUND: European importers who need to buy US dollars are not complaining about the current euro/dollar rate of exchange.

Yen and the art of market cycle maintenance

The yen resurgence that began this summer is still in play. But with the Japanese authorities still sporadically intervening in the currency markets, this upward path may meet some sharp setbacks. Simon Derrick, head of Bank of New York's currency…

Hedging Taiwan dollar risk

Exporters exposed to movements in the Taiwan dollar must hedge by using the non-deliverable forwards market. Michael Image, FX options structurer for northeast Asia at Standard Chartered Bank in Hong Kong, suggests a zero upfront premium solution, which…

‘Discount forward’ for hedging euro/sterling

With euro/sterling forecast to strengthen next year, Danny Goldblum, from HSBC’s global FX structuring team in London, proposes a solution to give a UK corporate that imports from Europe the protection of a forward contract at an improved rate

Total return analysis: currencies vs bonds

Establishing the risk and return characteristics of holding a currency position sometimes necessitates presenting a more formal economic interpretation of an FX transaction, says Robert Balan, head of financial market strategies at Saxo Bank in Copenhagen

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto

Cheap volatility brings yen opportunities

Japanese economic growth has outstripped many western economies over the past year, and the next currency breakout in the FX markets could be yen strength. Alex Schumann and Trevor Nathan, of Commonwealth Bank of Australia in Sydney, show how investors…

Cashflow control for pension portfolio hedges

Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency Management, offers a solution to an FX-related problem facing a UK pension fund

EUR-denominated diesel fuel hedge

There has been a recent trend for corporates to migrate the risk management of their commodity exposure from their procurement to their treasury departments. As the corporate’s risk is centralised, it is managed as part of a portfolio of more standard FX…

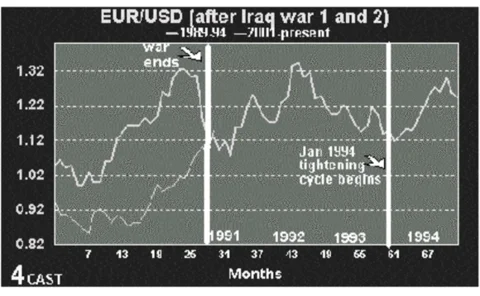

The George Jnr-George Snr divergence trade

George Bush Snr and Jnr’s presidential terms have been separated by nearly a decade. But, says Alan Ruskin, research director at 4Cast in New York, the economics on the surface look startlingly similar

Riding with the euro

A European client buying US dollars should consider a three-year swap to use the current euro strength to their advantage, says Pritpal Gill, head of structuring at Lehman Brothers in London

A firm view on the rand

Unexpected data revealing South Africa’s current account surplus has led Merrill Lynch to cite a firm view on the rand. Jos Gerson, chief economist for South Africa in Cape Town, explains key factors that must be taken into account in coming to a solution

The outperformance chooser option

Gavin Simms, head of FX strategies at Goldman Sachs in London, summarises an options solution for a euro-denominated corporate client looking to hedge sales in the US and Switzerland

Digital strike combats Korean hedging worries

A local importer in South Korea with upcoming dollar payables would be wise to consider a digital strike forward as tensions increase in North Korea, says Charlie Brown, head of structuring and solutions for global FX options at Standard Chartered Bank…