Opinion/Wholesale

The American double-accrual forward

With expected further euro appreciation, EUR/USD forwards are trading at a premium. Here, Anna Leung, head of corporate treasury marketing at HSBC, shows a way to get access to future hedging at a lower cost

Conservative approach to further dollar weakness

A one-year 'leveraged ratchet forward' may help hedgers looking for a conservative strategy who are expecting a lower EUR/USD next year, say Eric Ohayon, European head of FX structuring, and Chris Weiss, FX structurer, at Bank of America in London

Dynamic hedging strategies in Turkish lira

Emerging markets options offer the benefit of extreme differences in implied volatility and interest rate differentials. Here, James Davison, FX derivatives marketer at ABN Amro in London, outlines how corporate clients can see the benefits investors…

Prime brokerage best for individual investors

Individuals who want to trade FX may find a prime broker will promote confidentiality, cut out settlement difficulties and help resolve credit issues, says Peter Wakefield, MD of research and product development at Record Currency Management in the UK

Hedging Chinese renminbi revaluation

To boost returns on the event of Chinese renminbi revaluation, trading on the recently launched Bloomberg-JPMorgan Asian Currency Index (ADXY) is the best solution, says Erik Herzfeld, head of regional options trading at JP Morgan in Singapore, and…

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

Preparing for a break from range trading

Markets have been fairly flat over recent months. How can options traders make the most of this, and how should they prepare for a break from range? By Cornelius Luca, FX Concepts' New York-based head of client advisory for the Americas

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

How spreads can affect profitability

Spread cost makes a big impact on profitability, says Michael Stumm, co-founder and president of Oanda. Here he shows how to assess just how much different levels of spreads cost

Eliminating foreign exchange translation risk

FX translation can mis-represent a company's profit growth on its balance sheet. Cliff Bayne, senior exotics dealer, and Terence Yiu, chief dealer, at ABN Amro in Singapore, explain how to hedge the translation risk at minimal cost

Making amends for seasonal trends

Lower volatility and range-bound markets call for capital preservation with enhanced yields during the summer, says Jeffrey Lins, director of quantitative analysis at Saxo Bank in Copenhagen

Structured euro deposit adds cash as it hedges

A structured deposit denominated in euro can fulfill the twin goals of a European company by hedging its US dollar payables and generating a cash-rich position in its functional currency, says Didier Meyer, FX structurer at SG Corporate and Investment…

Solving investment problems with forex

An asset manager may look to euro/Swiss franc and euro/sterling structures to take advantage of investor uncertainty, says David Durrant, chief currency strategist at Julius Baer Asset Management International in New York

Profiting from the Chinese yuan

With speculation rife on the revaluation of the Chinese yuan, James Davison of the global FX derivatives marketing team at ABN Amro in London, examines potential ways for derivatives traders to benefit

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

Assessing the value of e-FX trading

Predicting future currency movements is not the only problem currency managers face. Finding the best method of dealing is also an issue, explains Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency…

Non-exporters still have exposure to currencies

Options could be the answer for a manufacturing company facing the twin problems of foreign competitors undercutting its prices and of the companies it supplies being less successful with an appreciating currency. Alex Barrett and Demetri Papacostas, of…

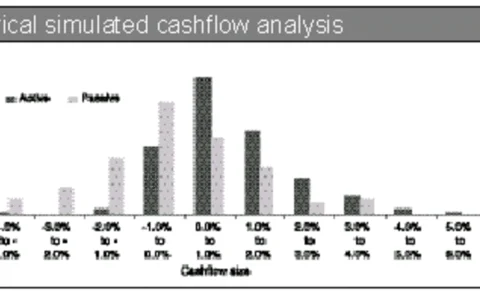

Cashflow considerations in currency overlay

Active currency overlay can reduce the risk of adverse cashflow arising from a strategic hedge, say Andrew Davies, director of capital market research, and Damhnait Ni Chinneide, portfolio manager at Lee Overlay Partners in Dublin

Dual deposits reap high-yield rewards

Ray Franzi, head of FX structuring at Dresdner Kleinwort Wasserstein in London, offers an opportunity for customers to achieve high Japanese yen deposit rates

Participating in rupee options

Following the launch of rupee options trading in India in July, Arun Khurana, head of financial markets distribution & derivatives marketing at ABN Amro in Mumbai, proposes a zero-cost 'participating forward' solution for an Indian client wanting to…

A ‘worst-of’ option to hedge dollar weakness

Andy Kaufmann, FX structurer at Merrill Lynch in London, explains a solution for an investor who is looking to benefit from a USD move against a variety of currencies

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto