Opinion/Wholesale

Facilitate to accumulate

Kim Fournais, chief executive of Saxo Bank, says the race to deliver the perfect multi-product trading platform need not be a zero-sum game

Lesson from Refco: keep it transparent

Yes, this is the second editorial in a row that I have written about Refco, but I make no apology for it. There are too many important lessons to be learned from the collapse for the industry to be able to move on as if nothing had happened.

Enigma – a cracking good model

Pete Eggleston, head of quant solutions at the Royal Bank of Scotland, financial markets, in London, discusses systematic trading of FX implied volatility using the 'Enigma' model

Time to get with the program

Banks are having to move rapidly to develop their platforms just to stand still. They have been launching new products onto platforms to meet demand from customers looking to do business in new ways, as shown by the increasing number of banks trading…

The passport option

Jeffrey Todd Lins, Director, Quantitative Analysis At Saxo Bank In Copenhagen, Suggests Passport Options As A Way To Maximise A Longer-Term View During Non-Trending Periods

Using a long straddle for EUR-USD participation

Armin Mekelburg, currency strategist at HVB in Munich recommends a way to take advantage of the strong swings in the eurodollar

Hedging rupee currency pairs

The global markets team at ICICI Bank in Mumbai suggests ways for Indian corporates to hedge against volatility in the Indian rupee currency pairs.

Don't fall behind, use the REER

The real effective exchange rate holds the key to how the government can manage damaging rupee fluctuation, according to Kotak Mahindra Bank's Treasury Solutions team in India

The technology to succeed

In-house technology will drive volumes and profit, says Charles Marston, chief executive officer at Calypso in San Francisco

Heading for the final USD selling opportunity

Hans-Guenther Redeker, global head of FX strategy at BNP Paribas in London, suggests a way to take advantage of the prospect of near-term dollar strength to protect against the likelihood of longer-term USD weakness.

Asia takes electronic currency route

Electronic currency networks are coming to the fore in Asia as daily trading volumes reach an all-time high, according to Michael Weiner, co-founder and managing partner at CoesFx

Hedging North Asia FX risk

Michael Image, FX structurer in Hong Kong, and Callum Henderson, head of FX strategy in Singapore, at Standard Chartered Bank, look at appropriate hedging strategies such as structured forwards or daily accrual forwards for hedging North Asian currency…

‘One size fits all’ is not appropriate

Sabrina Jacobs, FX strategist, capital markets, at Dresdner Kleinwort Wasserstein, says Asian currencies need to be looked at on an individual basis

‘FX markets are unreadable’

Foreign exchange markets are notoriously difficult to predict, so corporates shouldn’t bother, argues Simon Miles (right), currency strategist at Corporate FX. Instead they should focus on deciding how to hedge the risk so they can determine its real…

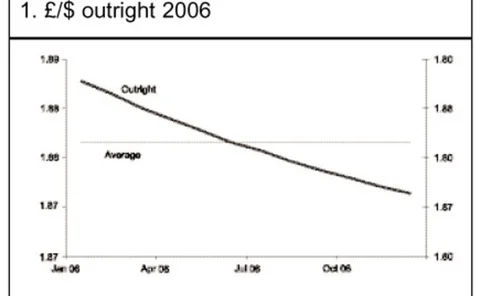

Selling £/$ at favourable rates to the forward

UBS Currency Management Advisory Service suggests using a ratio callable forward to sell GBP/USD at more favourable rates than the prevailing market forward rates

Capping downsides, tapping upsides

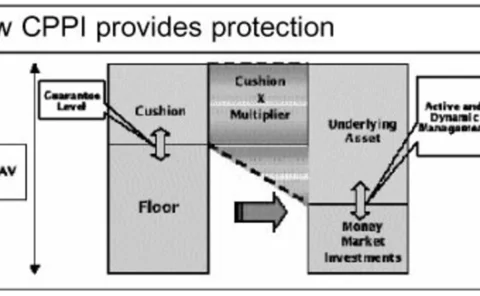

Jeffery Todd Lins (right), director of quantative analysis, and Peter Ager Hafez, senior research associate, at Saxo Bank, suggest a mechanism to cap the downside risk while allowing for upside potential in the absence of options on a currency fund

Emerging market opportunities

There are more options in emerging markets than you might think, says Scott Wacker (below), global head, client risk advisory and sales, ABN Amro in London

Fade-out zero-cost collar for hedgers

Since the beginning of the year, we have witnessed a EUR/USD spot consolidation below 1.37. Also, the last move from 1.2700 took EUR-USD up to the middle of the range 1.27 / 1.37. Many USD buyers are therefore looking to zero-cost collars, one of the…

Room for all providers

Contrary to much opinion in the market, Mark Warms, global sales and marketing director at FXall, says there is space in the market for all liquidity providers. He argues that hedge funds present an opportunity for the FX community

More options for hedge funds

Options give hedge fund managers a tool to manage spot currency trades outside of leaving simple orders in the market. Jeff Cooper (right), vice-president responsible for sales and structuring of FX options at Bank of Montreal in Toronto, explores this…

The greenback/HK dollar digital deposit

Hong Kong dollar interest rates remain suppressed. Michael Image, FX structurer for Northeast Asia at Standard Chartered shows a way for HK$ depositors to achieve higher interest rates by taking advantage of the fact that US$/HK$ forwards are trading at…

Towards risk-free emerging markets investment

Pete Eggleston, head of quantative solutions at Royal Bank of Scotland (RBS), outlines a way of benefiting from the high yields associated with emerging market investing while controlling the inherent risk