United States dollar

US dollar emerging from the woods, says SLJ Macro Partners

Weighing up the net effect of a negative outlook in the eurozone with positive growth signs in the US, Stephen Jen favours the US dollar

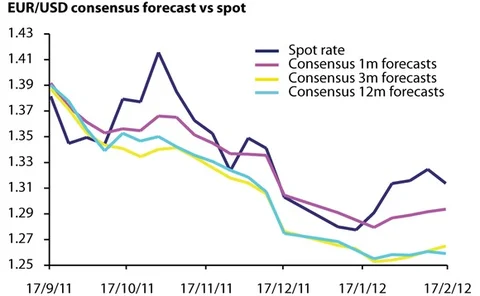

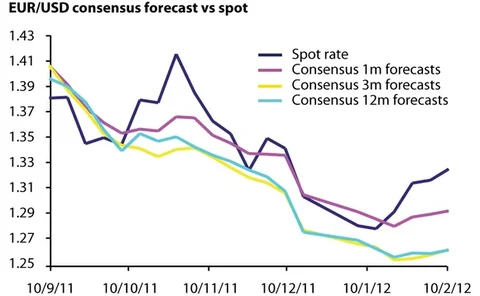

Nomura's moderate take on euro fall proves accurate

The Japanese bank tops this week's three-month rankings, having forecast accurately on both EUR/USD and USD/JPY

Exploit relative-value opportunities in EM currencies, says Investec

Turkish lira versus the Israeli shekel is a favourite relative-value play for Thanos Papasavvas, fixed-income and currency strategist at Investec Asset Management

Buy US dollar rather than EM currencies as a euro alternative, says Schroders

Clive Dennis, head of currencies at Schroders, doesn't share the widespread enthusiasm for EM currencies and recommends investors should buy the dollar as an alternative to the euro

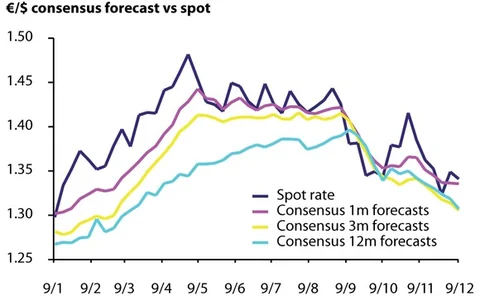

Greek deal brings early signs of calm in spot and options

Options traders say markets are reflecting a more relaxed view on the euro than in previous months, particularly following this week's Greek rescue package

Saxo takes mobile trading to new heights

Danish bank engineers the execution of a eurodollar trade on a mobile device during a base jump, as part of a new advertising campaign

Euro decline will accelerate in 2012, says Rabobank

Having forecast eurodollar to fall only moderately by now – a view that lands it at the top of the three-month rankings – Rabobank now expects a sharper fall

AUDIO: Heading into the perfect storm

Nick Beecroft, senior markets consultant at Saxo Bank in London, takes a critical look at the year ahead and says markets could be heading for the perfect storm.

Corporate hedgers count costs of volatility

Recent volatility in foreign exchange markets has created a tough hedging environment in major currencies, says British American Tobacco's dealing room manager

BAML: economic uncertainty favours yen

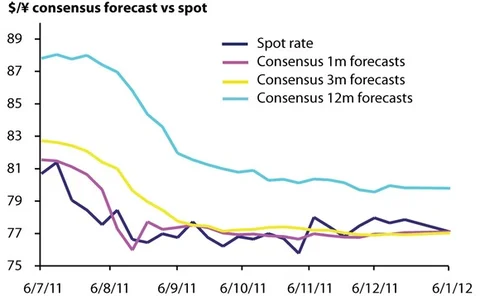

Bank of America Merrill Lynch tops the one-month forecasts with the view that the yen will remain strong in 2012

BMO’s three-month euro view on the money

Bank of Montreal tops three-month rankings after forecasting the euro would fall during Q4 of 2011

US dollar set for safe-haven flows in 2012, according to industry poll

According to 36% of respondents to FX Week’s latest online poll, the US dollar is the only real safe-haven currency, while 33% suggest there is still some promise in Nordic currencies

FXCM wins out with accurate medium-term euro view

Prediction that the euro would break out of its range during the fourth quarter lands FXCM at the top of the three-month forecast rankings

Banks dare to hope for calmer FX markets in 2012

Barclays Capital expects greater stability in the eurozone in Q1, but believes the euro will continue to depreciate

Eurodollar in freefall, says TMS Brokers

A bearish short-term view on the euro lands TMS brokers at the top of the one-month forecast rankings

Citi proves trading mettle in tough year for spot

Citi picks up six awards this year and climbs into second position overall, having effectively navigated the volatility that resulted from intervention in the yen and the Swiss franc

Deutsche scoops top FX award for third successive year

Having carefully tailored its product innovations to the challenging market conditions, Deutsche Bank picks up six awards in the 2011 Best Banks survey

Why the consensus is wrong on USD/JPY

RBC Capital Markets has taken a contrarian view on the yen for several years, predicting it would strengthen against the US dollar while the consensus forecast was for yen strength. After the bank’s contrarian view has proved accurate, Adam Cole argues…

Getting it right on Swiss franc strength

Rabobank, Westpac and Bank of Montreal scoop the awards for their forecasts on USD/CHF, having correctly anticipated the impact of the Swiss franc's safe-haven status on its strength

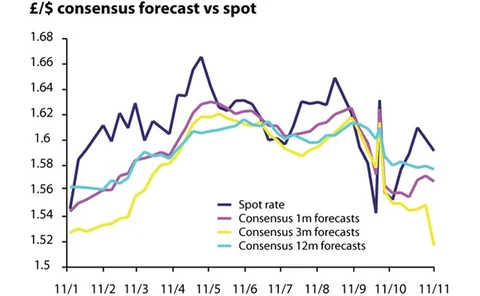

Tracking the effects of QE on cable

Commonwealth Bank of Australia, Wells Fargo and Standard Chartered take top position for GBP/USD forecasts through accurate analysis of the effects of central bank policies on the two currencies

Dollar weakness view lands Thomson Reuters on top

Thomson Reuters - IFR Markets took a view in November 2010 that GBP/USD would reach 1.6 and USD/CHF would reach 0.9 in a year's time, accurately reflecting spot rates last week

Exploring relative value

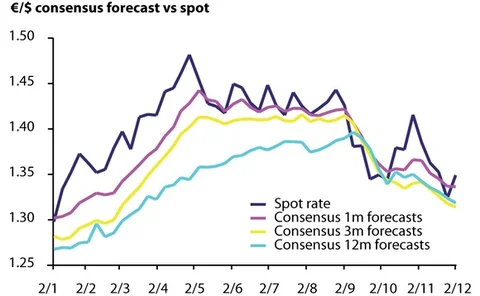

A rebound in risk assets in late October appears to have been short-lived and the foreign exchange market continues to be affected by lower-then-expected growth and a swinging pendulum between risk-on and risk-off. Callum Henderson argues relative value…

Political crisis in Europe brings volatility back to FX options

Volatility returned to eurodollar last week as FX traders priced further downside risk into euro options

Spotlight on: Collin Crownover, SSgA

State Street Global Advisors’ head of currency management talks to Joel Clark about investor appetite for G-10 and emerging market currencies, and how his global team has managed the volatility and political uncertainty that has characterised the foreign…