United States dollar

StanChart’s bearish call on majors wins out

Standard Chartered took a bearish three-month outlook on three major currencies in March, landing the bank at the top of this week’s rankings

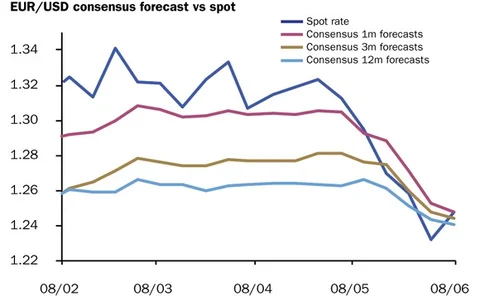

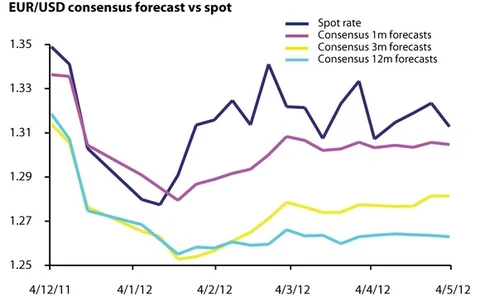

Eurodollar on its way to parity, says FXCM

An accurate three-month forecast on the euro's plummet to 1.25 against the dollar lands FXCM at the top of this week's forecast rankings

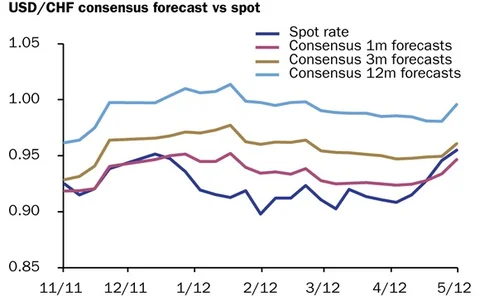

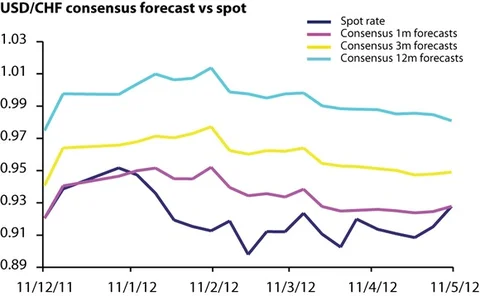

Lloyds spot-on with Swissie weakness bet

Lloyds lands itself at the top of the one-month forecast rankings after its accurate prediction of Swiss franc weakening during May

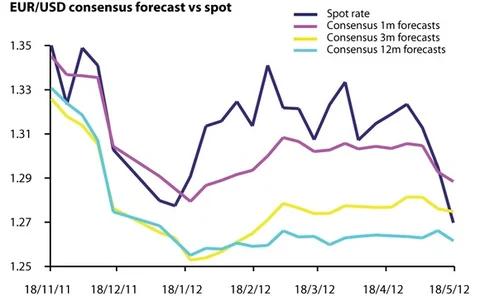

Scotiabank on the mark with bearish euro call

The Canadian bank accurately predicted in late February that the euro would fall, landing it on top of the three-month forecast rankings

SEB rises in rankings as Swiss franc falls

SEB accurately forecast that Swiss franc would weaken against the dollar in its mid-April forecasts, putting the Swedish bank at the top of the one-month rankings

Greece will stay in the eurozone, says Deutsche’s FX strategy head

Alan Ruskin explains why a Greek exit is less likely than some have suggested, with several factors supporting the country’s future in the eurozone

Forex markets absorb political chaos in Europe

Participants reacted relatively calmly to political developments in Europe last week, and the absence of credible alternative currencies prevented a major sell-off

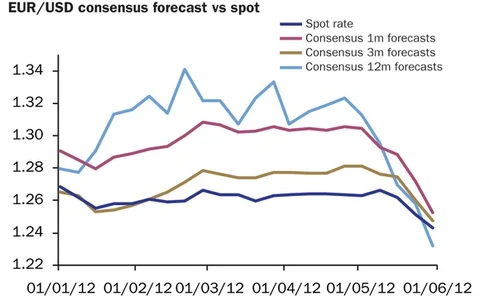

Crédit Agricole wins with steady euro bet

Crédit Agricole accurately forecast a modest dip in EUR/USD and a rise in USD/JPY in its mid-February forecasts, landing it at the top of the three-month rankings

Aussie demand surges following RBA rate cut

The Reserve Bank of Australia’s decision to cut interest rates on May 1 led to a sharp fall in the Australian dollar, but has also caused an uptick in demand for the currency, according to FX traders and strategists in the region

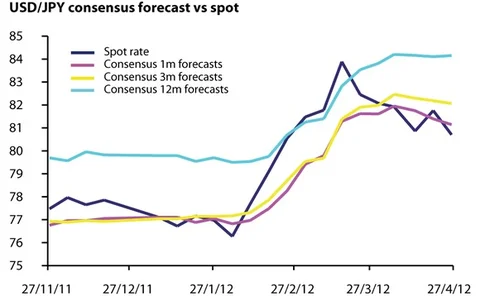

Yen will go from strength to strength, says ANZ

The Australian bank forecast a yen revival last month, landing it at the top of the one-month rankings – and it expects the Japanese currency will continue to gain ground this year

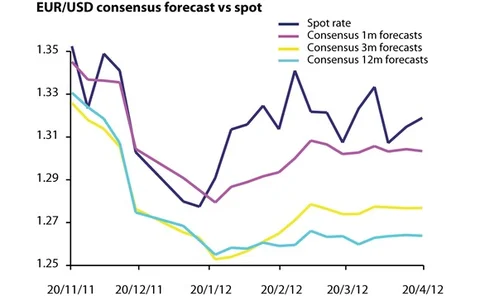

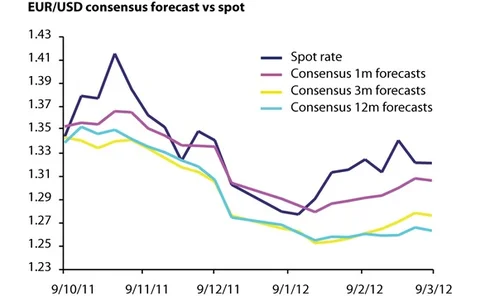

Eurodollar caught in range-bound tug of war

Currency strategists are divided over whether EUR/USD will break out of the 1.30-1.35 range it has traded in since late January

CME to launch portfolio margining on interest rate swaps and futures

Dealers will be able to cross-margin interest rate swaps, and eurodollar and Treasury futures, from May

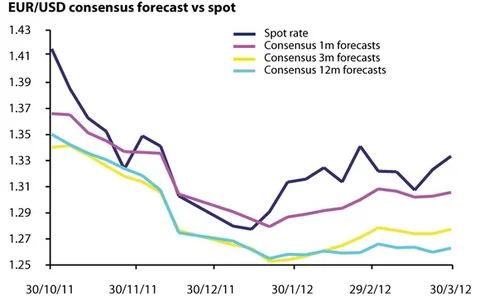

Why the Q1 risk rally was a glass half empty

Following a risk rally in foreign exchange markets during the first quarter, several of the positive drivers of that rally have now dissipated. Looking ahead to the rest of the year, Callum Henderson explains why investors should continue to short…

Danske wins with range-bound euro forecast

The Danish bank accurately forecast on March 23 that EUR/USD would remain at 1.32 in a month’s time – a view that proved entirely accurate

Chart-topping CMC goes against the grain on yen

Strategists at CMC Markets took an accurate view on the long-term direction of two major safe-haven currencies in 2011, landing the firm top in the 12-month forecast rankings

Spotlight on: Raymond Kamrath, Faros Trading

Faros Trading has made a number of senior appointments to its sales team in recent months as it eyes global expansion from its headquarters in Stamford, Connecticut. Chief executive Raymond Kamrath talks to Chiara Albanese about the growth of the firm…

Reserve managers cling to the dollar but shun the euro, survey finds

Many central banks have reduced their holdings of euro reserves and looked to diversify into non-traditional currencies as a result of the ongoing eurozone crisis

Spotlight on: John Taylor, FX Concepts

The founder and chief executive of FX Concepts talks to Melanie White about the growth and diversification of the currency management firm over the past three decades, and his current views on major currencies

A spot of bother

Traders exploiting the spread between CNH deliverable forwards and CNY NDFs got a nasty surprise in September last year, when the basis trade blew up amid a reversal of the spread. Georgina Lee looks at what investors can learn from this turn of events

Morgan Stanley calls time on euro and sterling rally

The US bank accurately forecast the euro and sterling would rally moderately against the US dollar during the first quarter, landing it at the top of the one-month rankings, but believes both currencies will now depreciate

CMC on top of ECB's 2011 rate hike reversal

CMC Markets accurately predicted the euro would rise and then fall as the ECB reversed its interest rate policy in 2011

LTRO-based euro forecast pays off for Wells Fargo

The US bank predicted a very moderate fall in eurodollar by early March as a result of the second longer-term refinancing operation, landing it at the top of the one-month rankings

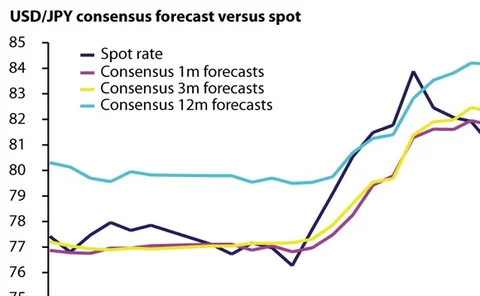

Market divided on sustainability of yen slump

Barclays Capital has revised its USD/JPY forecasts upwards, but other banks believe the recent fall of the yen will turn out to be a short-lived trend

FX Invest Europe: Developed market currencies still important despite EM buzz

The recovery of major economies will be crucial to the profitability of FX markets, despite the greater returns to be generated from emerging market currencies, according to conference speakers