Regulation

Portals tackle liquidity issues

NEW YORK – The rise in anonymous trading has changed the way banks distribute liquidity.

OCC reports decline in forex derivatives trading

WASHINGTON, DC – Foreign exchange has bucked the trend for derivatives trading with a fall in value for the first quarter of the year, according to the US Office of the Comptroller of the Currency (OCC).

Euro fall to continue, say analysts

LONDON, COPENHAGEN AND NEW YORK – The euro is set to stay weak against the dollar, according to FX strategists.

Five charged over $3m currency fraud

WASHINGTON, DC – The US Commodity Futures Trading Commission (CFTC) has filed another action against individuals taking part in fraudulent foreign exchange trading.

InfoReach adds HotspotFXi to TMS

NEW YORK – InfoReach, the financial securities trading technology firm, has teamed up with Hotspot FXi, the online foreign exchange platform, to allow its clients access to its prices.

Romania takes Delta Dealing System

Bucharest – Dublin-based software vendor Delta Community has successfully entered the Romanian market.

‘FX markets are unreadable’

Foreign exchange markets are notoriously difficult to predict, so corporates shouldn’t bother, argues Simon Miles (right), currency strategist at Corporate FX. Instead they should focus on deciding how to hedge the risk so they can determine its real…

‘No’ votes lead to record flows

LONDON – The ‘no’ votes on the EU constitutionreferendums last week led to unexpectedvolatility in the currency markets, and the highestvolumes ever seen on some platforms.

Deutsche loses staff across desks

LONDON – Deutsche Bank in London has haemorrhaged five foreign exchange staff from structuring, sales and trading in recent weeks. Jeremy Smart, director of FX structuring, who reported to Rhomiaos Ram, global head of complex risk, has been linked with a…

Benefiting from yuan revaluation

The Lloyds TSB Financial Markets team suggests how to benefit if the Chinese yuan revalues and Asia follows suit

UK least likely to adopt euro

GLOBAL – Of the European Union members yet to join the euro, the UK is the least likely to join the single currency, according to a survey of FX Week readers.

Top stories from 15 years of FX Week AIB losses a 'one-off'

LONDON – The foreign exchange industry is unanimous in its verdict that the disastrous $750 million FX loss announced by AIB last Wednesday was a one-off event.

Reuters bids farewell to Fleet Street

LONDON – Reuters, the global information provider, is ending its longstanding relationship with Fleet Street by completing a move to new headquarters in London's Canary Wharf.

SuperD launches reval product

NEW YORK – Pricing systems vendor SuperDerivatives has expanded its suite of services with the launch of a revaluation service.

Prime brokerage threatening banks

LONDON – Banks are charging far too little for prime brokerage to be profitable, according to market players.

Chinese whispers cause confusion

BEIJING – Currency markets were thrown into disarray last Wednesday following an inaccurate news report by a Communist-party-backed news agency claiming China would allow the yuan to appreciate.

Prime brokerage threatening banks

LONDON – Banks are charging far too little for prime brokerage to be profitable, according to market players.

French referendum ups volatility

PARIS – The French referendum on the European Union (EU) constitution, set for May 29, has already affected euro trading, and continuing uncertainty will lead to further volatility.

Diverging views over renminbi

BEIJING – Banks have divergent views on the likely size, extent and timing of a revaluation of the Chinese renminbi (CNY).

GFI expands Fenics with bank volatilities

NEW YORK – Interdealer broker GFI is expanding the coverage of its Fenics pricing and risk tool to include volatility surfaces – the methods by which options are priced – from bank clients.

CLS set to expand remit

LONDON – CLS could substantially increase its remit with the introduction of a matching and netting facility for non-eligible currencies and settlement of options, non-deliverable forwards, futures and credit derivatives.

MAS to maintain "modest" currency appreciation

SINGAPORE – The Monetary Authority of Singapore (MAS) will maintain its "policy of modest and gradual appreciation" for the Singapore dollar at its semi-annual monetary review tomorrow (April 12), analysts have predicted.

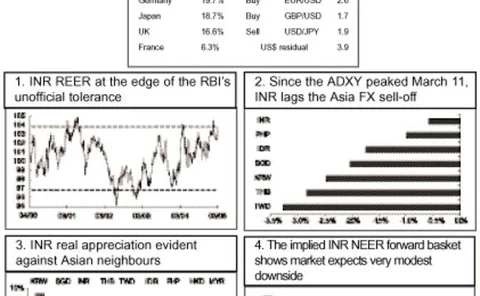

INR – everything is relative

The INR’s over-extended valuation against the Reserve Bank of India’s REER implicit policy anchor continues. This over-extension is looking anomalous against the continued backdrop of Asian FX selling. Claudio Piron, Asian FX strategist at JP Morgan in…

Best execution: not just price, but what else?

Process and practice should both be given serious attention before agreement can be reached on best execution in FX. By Chip Lowry (right), MD, Global Link Europe