Regulation

Saxo gets London go-ahead

COPENHAGEN AND LONDON – Danish forex specialist Saxo Bank has received approval from the FSA in London to open its new headquarters in the city ( FX Week , September 26).

HSBC breaks into top three

LONDON - UBS has held on to the top spot to be named FX Week Bank of the year for the third year in a row. But the biggest upset sees HSBC break into the top three at Citigroup's expense.

BoJ/MAS sign second swap agreement

TOKYO & SINGAPORE - An agreement between Singapore and Japan to trade swaps signed earlier this month is the latest sign of closer co-operation between Asian economies.

HSBC breaks into top three

LONDON - UBS has held on to the top spot to be named FX Week Bank of the year for the third year in a row. But the biggest upset sees HSBC break into the top three at Citigroup's expense.

Brokers pulled into NAB scandal

MELBOURNE – National Australia Bank NAB) is demanding more than A$539 million ($394 million) in compensation from interdealer broker Icap and another unnamed broker for losses the bank incurred following last year's rogue-trading scandal.

IAS 39 sparks hedging concerns

LONDON – Accounting rule IAS 39 is causing distortions between economic reality and financial reporting, with rules regarding the use of derivatives likely to impede companies.

Fraudulent FX sites uncovered

WASHINGTON, DC – The US Commodity Futures Trading Commission (CFTC) has filed yet another action against a party participating in fraudulent forex activity.

FX volumes ‘up one fifth’ in past year

LONDON – A surge in active currency management has driven up FX volumes by 20% in the past year, according to London-based research firm ClientKnowledge.

Using a long straddle for EUR-USD participation

Armin Mekelburg, currency strategist at HVB in Munich recommends a way to take advantage of the strong swings in the eurodollar

JPMTS signs up CLS third party

BERLIN – JP Morgan Treasury Services has signed up ADM Derivatives as a CLS third-party client, as part of a solution the bank is offering, which includes a suite of multi-currency accounts.

Bloomberg enters FX options market

NEW YORK – Bloomberg is continuing to build up its portfolio of FX tools with the planned introduction of FX options trading.

Greenspan and Snow to visit Cfets

BEIJING – Alan Greenspan, Federal Reserve chairman, and John Snow, treasury secretary, will visit the Shanghai office of the China FX trading system (Cfets) on their visit to China this week.

Central banks increase FX holdings

BEIJING AND WASHINGTON DC – A Chinese official last week highlighted the possibility of a significant move out of US dollar reserves, as the latest IMF figures show central banks have continued to hold faith in the greenback.

Structured products in the spotlight

WASHINGTON, DC – Concerns over the mis-selling of structured products to investors in the US has prompted the National Association of Securities Dealers (NASD) to issue guidelines to ensure members fall within the scope of sales practice codes.

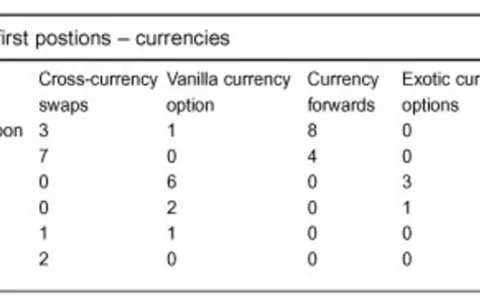

CST merger leads to derivatives domination

LONDON – The £132 million Collins Stewart Tullett (CST) acquisition of Prebon Yamane last October has propelled the combined group to domination of the broker categories for interest rate and currency derivatives in sister pulication Risk 's 2005 inter…

Eurex to roll out its futures platform in United States

CHICAGO & Frankfurt – Eurex, the Frankfurt-based derivatives exchange, will be rolling out its FX futures platform in the US this month as planned, confirms an official at the exchange in Frankfurt.

Banks risk US regulatory backlash

NEW YORK – FX banks could face a regulatory backlash in the US for the mis-selling of FX products by retail brokers, warn market players.

Dollar boosts FX derivatives

BASLE – The rally in the US dollar has worked to the benefit of exchanges offering trading in currency derivatives.

Hedging rupee currency pairs

The global markets team at ICICI Bank in Mumbai suggests ways for Indian corporates to hedge against volatility in the Indian rupee currency pairs.

Heading for the final USD selling opportunity

Hans-Guenther Redeker, global head of FX strategy at BNP Paribas in London, suggests a way to take advantage of the prospect of near-term dollar strength to protect against the likelihood of longer-term USD weakness.

The relative merits of zero-premium structures

Zero-premium structures can do a better job as a hedge than a vanilla instrument, when the full cost of insurance is paid. By Kenrick Ramlochan, director, FX analytics and risk advisory at ABN Amro in London

US banks boosted by foreign exchange

NEW YORK – US banks have posted a strong Q2 for FX in recent weeks.