Regulation

Banks' 'indifference' to IAS 39 hints at software panic-buying

LONDON -- Software vendors are preparing to take advantage of any bank glitches once the IAS 39 accounting standard is implemented on January 1.

Cautious corporate approach to IAS 39

LONDON -- Corporates will look to use less complicated products because of the IAS 39 hedge accounting rules, as some believe it could signal significant changes in risk management strategies, according to Georgette Bailey, director, strategic solutions…

CLS below half of FX activity

LONDON – CLS lacks traction outside the major banks and still accounts for far less than half of all FX transactions, according to a report by the Bank of England published this week.

Opec turns its back on dollar

BASEL – Opec members have been reducing US dollar exposure in favour of the euro over the past three years, according to statistics released by the Bank for International Settlement (BIS) last week.

Intervention will not halt dollar weakness

SEOUL – The dollar's dive against Asian currencies to record lows is unlikely to be halted by large-scale intervention, according to analysts.

Euro role grows, says ECB

The euro is increasingly being used as an international currency and its place in the global markets is becoming ever more important, a European Central Bank (ECB) official told delegates at the FX Week congress in London last week.

Dynamic hedging strategies in Turkish lira

Emerging markets options offer the benefit of extreme differences in implied volatility and interest rate differentials. Here, James Davison, FX derivatives marketer at ABN Amro in London, outlines how corporate clients can see the benefits investors…

Protecting against losses while making gains

Given the rapid, one-way move in the Canadian dollar (CAD), many hedgers who are short CAD are looking for innovative hedging ideas. John McAuliffe, manager, US FX options sales at the Bank of Montreal in Chicago, suggests some options

Bayer Group's two-year plan pays off

LEVERKUSEN – As the dollar continues its slide versus all major currencies – it has lost 8% of its value against the euro in the past two months and 9% against the Swiss franc – corporates are struggling to readjust their hedging strategies.

Concerted intervention ruled out

FRANKFURT – Despite increasingly vigorous comments from European politicians arguing in favour of stemming the onward rise of the euro, concerted intervention from Europe and the US is extremely unlikely.

Banks review yuan reval forecasts

BEIJING – Some bank analysts have brought forward their expectations of regime change in the Chinese yuan, following the rate hike by the People's Bank of China late last month.

Bush win prompts dollar sell-off

NEW YORK – The re-election of President George W. Bush last week prompted a dollar sell-off, sending the euro to an all-time high just below 1.30 by close of trading on Friday (November 5).

RBS launches IAS 39 kit for corporate clients

The Royal Bank of Scotland launched a web-based IAS 39 Toolkit last week to help clients with the requirements set out by the IAS 39 accounting standard, which comes into force at the start of 2005.

New retail laws spark alarm in Japan

TOKYO – A debate is raging in Tokyo over the impact new retail FX trading laws will have on the developing market.

China rate hikes boost FX volatility

CHINA – Volatility in global FX has surged amid speculation that the first rate hike by the People's Bank of China (PBOC) in almost a decade could spark a sooner-than-expected yuan revaluation, according to analysts.

Funds repatriation bill set to pass

NEW YORK – A bill offering US companies the chance to repatriate overseas earnings at a hugely discounted tax rate is set to be signed into law in the next week – much sooner than previous estimates, said analysts.

Chinese currency to rise by 25% against dollar

LONDON – China's currency is up to one quarter below its true value and a significant adjustment on the forex market is inevitable.

SIBOS 2004

CLS rules the roost at Sibos

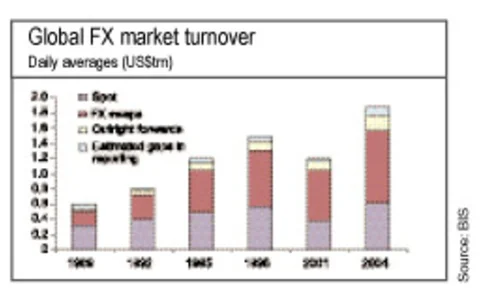

BIS paints bright future for FX

BASEL – The huge growth in daily turnover in the global foreign exchange market, revealed in the Bank for International Settlements’ (BIS) triennial FX survey last week, has painted a bright future ahead for forex market participants.

Making the most of upcoming volatility

For the currency overlay manager looking to take advantage of a burst of market volatility at the start of the fourth quarter, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their…

Optimism ahead of latest BIS FX trade figures

BASEL – Banks are bullish about the Bank of International Settlements' (BIS) latest FX trading figures, due out in a survey this week.

Sun Platinum pays $40 million penalty

WASHINGTON – FX trading firm Sun Platinum was last week ordered to pay $40 million in civil penalties and restitution to customers, after a US district court entered a default judgment against the firm.

NAB to re-open options desk

MELBOURNE – National Australia Bank hopes to re-open its currency options desk in the "near-term", said chairman Graham Kraehe last week. However, the bank refused to be drawn on a date, saying it was up to regulator the Australian Prudential Regulation…

Politics fail to dampen hopes for forint

BUDAPEST – The resignation last month of Hungary's prime minister Peter Medgyessy has not led to the trading opportunities that may have been expected from the country's currency, the forint.