Trading

Spotlight on: Sven Carlsson, Ericsson Group

The head of markets at Ericsson talks to Joel Clark about the change in the telecommunications group’s treasury function and FX hedging strategy over the past 17 years, as well as his views on new regulation

Weighing up renminbi prospects

Despite the high-profile attention to London's potential as the western hub for renminbi business, central bank and corporate appetite for the currency appears lukewarm

Why the Q1 risk rally was a glass half empty

Following a risk rally in foreign exchange markets during the first quarter, several of the positive drivers of that rally have now dissipated. Looking ahead to the rest of the year, Callum Henderson explains why investors should continue to short…

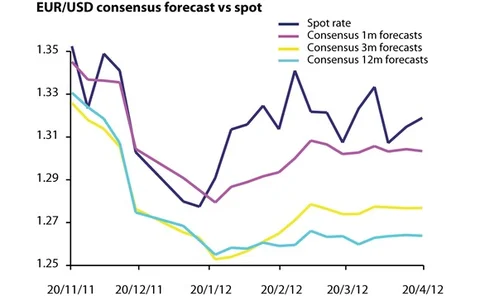

Danske wins with range-bound euro forecast

The Danish bank accurately forecast on March 23 that EUR/USD would remain at 1.32 in a month’s time – a view that proved entirely accurate

Investors flock to the Mexican peso

Following significant appreciation of the Mexican peso during the first quarter of 2012, the currency has become a favourite emerging market bet for investors, and market participants believe it will stay that way. Melanie White reports

Overcrowded market for forex options platforms will lead to consolidation

With at least six new multibank options platforms now competing for market share, differentiation is crucial for participants, but some believe consolidation of platforms is also inevitable. Chiara Albanese reports

FX Invest North America: Eurozone crisis resolution still unclear

Panellists at FX Invest North America divided on whether the eurozone crisis will lead to the exit of Greece from the currency union

Economic recovery on track but risks remain, warns IMF

Global growth should rise from 3.5% to 4.1% next year, although capital flows into emerging markets give some cause for concern, according to a senior IMF official

Cyprus becomes latest stop in Saxo’s global expansion

Saxo Bank is continuing its move into new markets with the opening of a Cyprus office today, headed up by Vitali Butbaev

HSBC in Hong Kong retail forex foray with Oanda

HSBC launches margin FX trading services for retail investors in Hong Kong using technology by Oanda

ADS Securities pitches to high-net-worth individuals

The Abu Dhabi-based trading firm last week launched ‘Prime’, a new service targeted at professional and high-net-worth forex and bullion traders

Brakes remain on FX options clearing, despite regulatory easing

CPSS-Iosco working group ruled last week that CCPs do not have to guarantee settlement, but participants recognise the issue still has some way to run before options can be centrally cleared

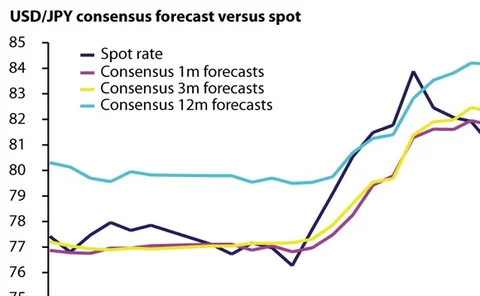

Chart-topping CMC goes against the grain on yen

Strategists at CMC Markets took an accurate view on the long-term direction of two major safe-haven currencies in 2011, landing the firm top in the 12-month forecast rankings

Spotlight on: Raymond Kamrath, Faros Trading

Faros Trading has made a number of senior appointments to its sales team in recent months as it eyes global expansion from its headquarters in Stamford, Connecticut. Chief executive Raymond Kamrath talks to Chiara Albanese about the growth of the firm…

Fears over regulation raised by treasurers at ACT conference

Corporate treasurers complain about the unintended consequences of the proposed financial transaction tax, as well as clearing rules for OTC derivatives and Basel III capital rules

The quasi-extinction of free-floating exchange rates

Imran Ahmad and David Petitcolin of the emerging markets FX strategy team at Royal Bank of Scotland in London say the quest for growth by emerging and developed market nations has led to the quasi-extinction of free-floating exchange rates

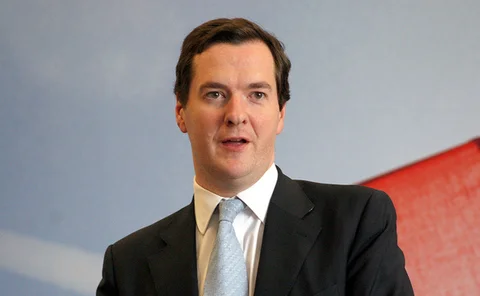

City’s top brass throws weight behind London RMB initiative

London will become the next offshore centre for RMB trading, vows UK chancellor George Osborne, supported by banking chiefs from Bank of China, Barclays, Deutsche Bank, HSBC and Standard Chartered

Algo execution sales head departs Credit Suisse

Jonathan Wykes, formerly global head of FX sales for Credit Suisse’s algorithmic execution business, has left the bank

State Street back under spotlight as Connecticut attorney general investigates FX charges

US custodian bank in further pricing setback

Spotlight on: John Taylor, FX Concepts

The founder and chief executive of FX Concepts talks to Melanie White about the growth and diversification of the currency management firm over the past three decades, and his current views on major currencies

Credit Suisse loses head of FXPB

Paul Houston, Credit Suisse's London-based global head of FX prime brokerage, has left the bank

Currency floor breach raises questions over SNB policy

The Swiss National Bank should consider enlisting the help of top-tier banks to keep EUR/CHF above 1.20, forex traders suggest

FXall enters monthly volume contest with strong March results

Average daily volume on FXall in March was $90.4 billion, up 9% on March 2011

Veteran EM trader exits RBS for the buy side

Eric Lieberson has left Royal Bank of Scotland after 17 years, to join Civic Capital, a New York-based advisory firm set to launch a hedge fund later this year