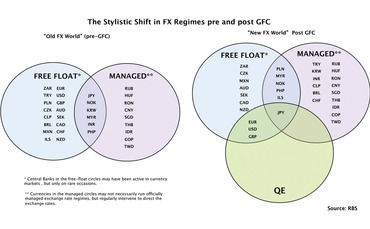

The quasi-extinction of free-floating exchange rates

Central banks have become the new rulers of global currency markets, which suggests significant implications for their participants. Certainly, the quest for growth by emerging and developed markets has resulted in heavy-handed meddling by central banks. Among the central banks of the eurozone, Japan, UK and the US (G-4), this has taken the form of quantitative easing, while in the emerging markets it's been through intervention. In some cases, this has suppressed FX volatility, leading to a disconnect between fundamental drivers and exchange rate performance – challenging the free-float mantra that dominated before the global financial crisis.

The global fight to depreciate is no better illustrated than by the accumulation of $3.4 trillion in global FX reserves since 2008, almost matching $4.8 trillion in G-4 liquidity injections since the crisis.

What we are observing is a dramatic shift from the free-float mantra that dominated pre-crisis for the 31 most liquid global currencies, to a new world order in which only seven currencies have not embarked on any intervention: ZAR, CZK, MXN, AUD, SEK, CAD and NZD. The PLN, MYR, NOK, PHP and ILS have been relatively hands-off while TRY, RUB, HUF, RON, CNY, SGD, THB, KRW, IDR, INR, CLP, BRL, COP, TWD and CHF are countries inclined to meddle. Meanwhile, the G-4 currencies, USD, EUR, GBP and JPY, have been affected by quantitative easing (QE).

This new FX landscape has some important implications. Firstly, traditional drivers for FX markets, such as rate spreads and balance of payments, have temporarily taken a back seat as rate markets converge to low range-bound levels. Markets are increasingly driven by central bank policy, making way for game theory to predict who is going to intervene or conduct QE. We have also seen a collapse in FX volatility as central banks moderate any dramatic exchange rate movements. While volatility was equally low pre-crisis, this was more reflective of clear trending markets, rather than the directionless ‘choppiness' witnessed currently.

The natural response from market participants that no longer have the clout to 'take on' central banks is to focus trading and investment activity around the remaining hands-off currencies (ZAR, CZK, MXN, AUD, SEK, CAD, NZD, PLN, MYR, NOK, PHP and ILS). This present FX regime is likely to result in fewer directional trends and increased choppiness in FX markets, while increasing event risk from central bank announcements.

While the 'DM QE wars' and 'EM currency wars' heat up, there are clear risks in central banks deviating from free market mantra and influencing the FX markets. Indeed, central banks are removing a key parameter in economic adjustment, which can result in unintended consequences and undesired long-run imbalances. One key risk of maintaining an artificially low currency either through QE (increase in money supply) or FX intervention is higher inflationary pressures, and in the most extreme case asset price bubbles. Meanwhile, financing reserve purchases via the issuance/sale of sovereign bonds, that is, sterilisation, in order to prevent inflationary pressures typically entails a financial cost for the central bank, either due to forgone interest on bonds sold or the interest paid on issued securities. There are also repercussions concerning the structure of an economy, as countries that maintain depreciated exchange rates to boost growth risk excessively promoting export-led growth and consequently reliance on foreign demand. This can lead to economic imbalances and prevent the growth and development of the domestic economy.

There are no better representatives of the new FX world order, and the power struggle within, than the Brazilian authorities, which recently declared their country would not play the "idiot's role" by letting its currency appreciate while rich nations artificially devalue theirs to gain market share. Essentially, the quest for growth by EM and DM nations has led to the quasi-extinction of free-floating exchange rates. The most striking case in EM FX is obviously BRL, where the authorities have engaged in a plethora of regulatory measures aimed at staving off excessive speculation in BRL assets.

Asian central banks have historically been heavy meddlers in FX markets, even before the crisis. There has been a modest appreciation bias from central banks as the domestic growth component grows and inflation pressures are restricted. However, the Obama-Wen meeting last November saw a dramatic shift from China regarding CNY ‘flexibility' leading to the demise of the popular CNY appreciation trade. Despite rhetoric about greater CNY ‘flexibility' (wider intra-day volatility), there has been little follow-through in the fixes. With other Asian countries clearly concerned about their competitiveness vis-à-vis China, central banks are choosing to manage exchange rates.

In the G-10, too, central banks have assumed control, with the CHF being the clearest example, as the central bank implements a de facto peg at the 1.20 level (EUR/CHF). G-4 FX for its part is increasingly affected by the actions of central banks. The yen strengthening over the past three years has led to repeated (but ultimately unsuccessful) intervention by the central bank, while in February the Bank of Japan surprised the market by increasing its asset purchase plan by ¥10 trillion to ¥65 trillion while simultaneously setting a 1% inflation goal. Meanwhile, repeated rounds of QE in the UK and the US have led to minimal volatility in rates markets, in turn suppressing volatility in FX markets.

Only when traditional growth drivers re-emerge and central banks wean themselves off monetary/exchange rate-stimulated growth will central banks once again take a back seat and no longer rule the FX universe.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@fx-markets.com or view our subscription options here: https://subscriptions.fx-markets.com

You are currently unable to print this content. Please contact info@fx-markets.com to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Foreign Exchange

Average reported daily UK FX turnover hits record high

Daily turnover of $2,881bn in October 2019, up 2% from previous high of $2,821bn in April

PBoC injects 1.2 trillion yuan as markets plunge

Chinese central bank eases to support economy as coronavirus spreads; Q1 GDP growth could drop to 4%

Spot volumes on platforms resumed downward trend in 2019

But an uptick was seen in FX swaps and forwards submitted for settlement

PBoC extends market closure as coronavirus spreads rapidly

Chinese central bank extends interbank markets closure and vows to maintain ample liquidity