Trading

War threat to Q1 FX profits

NEW YORK – The impact of the war in Iraq on FX will become clear this week, when the US commercial banks publish trading revenues for the first three months of the year.

Singapore dollar hit by SARS woes

SINGAPORE -- Speculation mounted last week that the Monetary Authority of Singapore (MAS) had intervened to protect the Sing dollar’s narrow trading range, as fears over the SARS virus escalated.

When stocks rocket

Markets are expecting a post war rally in equities. Jesper Dannesboe, chief FX strategist at Dresdner Kleinwort Wasserstein in London, looks at the implications for FX

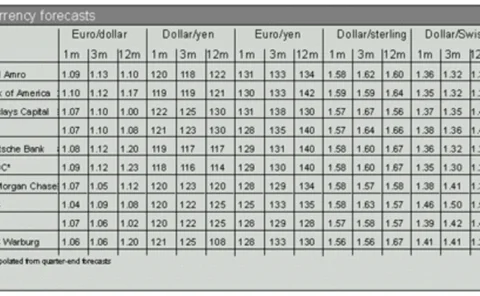

ABN, Deutsche top forecast rankings

LONDON -- ABN Amro was the most accurate currency forecaster based on a one-month prediction made on March 7, while Deutsche Bank took top spot for 3m forecasts submitted three months ago in FX Week ’s table of forecasters (see below).

More prime brokers take to web

LONDON -- Automation of the prime brokerage industry is well underway, with a host of new services set to hit the market in the coming months.

Dare to compete

The Canadian dollar has a chance to shine, but will domestic exporters seize the opportunity? asks Craig Larimer (right), managing director, international research group, Banc One Capital Markets in Chicago

The ‘leverage range forward’ approach

A UK company exporting to the US looking to hedge long-term USD receivables may enter a ‘leverage range forward’ strategy to boost the hedge level, says Didier Meyer, FX options structurer and marketer at SG in Paris

Japan confirms March interventions

TOKYO -- The Bank of Japan, on behalf of the Ministry of Finance, spent nearly ¥1.2 trillion in March in a bid to ease the Japanese currency’s strength against the dollar and the euro.

Dollar consolidation brings FX manager joy

STAMFORD, CT -- A temporary halt in the US dollar’s downtrend helped 60% of currency managers on the Parker FX Index maintain positive returns in February. But returns were limited -- the index was up just 0.16% for the month.

Reuters mounts EBS challenge

LONDON -- Reuters is mounting a bid to unseat the Electronic Broking Service (EBS) as the premier broker in euro/dollar, a senior Reuters official told FX Week .

Market suspects yen intervention

TOKYO -- Speculation was rife in FX markets last week that the Bank of Japan was intervening to attempt to keep the yen above 120 per dollar ahead of the Japanese fiscal year-end today (March 31).

Tech glitch strikes CLS

NEW YORK -- The failed settlement of over 20,000 Australian dollar and Japanese yen trades on the Continuous Linked Settlement (CLS) service last week was caused by multiple technical faults, senior CLS officials told FX Week .

The fog of war

What should you do when near-term uncertainties cloud the FX outlook? Concentrate on the medium term and rely on the fundamentals, say Yianos Kontopoulos (right) and Marcel Kasumovich, FX strategists at Merrill Lynch in New York

Manila clamps down on ‘dollar hoarders’

MANILA -- Bangko Sentral ng Pilipinas, the Philippines central bank, last week imposed monetary and non-monetary sanctions on eight banks for violating FX laws.

Tech glitch strikes CLS

NEW YORK -- The failed settlement of over 20,000 Australian dollar and Japanese yen trades on the Continuous Linked Settlement (CLS) service last week was caused by multiple technical faults, senior CLS officials told FX Week .

The outperformance chooser option

Gavin Simms, head of FX strategies at Goldman Sachs in London, summarises an options solution for a euro-denominated corporate client looking to hedge sales in the US and Switzerland

Market suspects yen intervention

TOKYO -- Speculation was rife in FX markets last week that the Bank of Japan was intervening to attempt to keep the yen above 120 per dollar ahead of the Japanese fiscal year-end today (March 31).

The fog of war

What should you do when near-term uncertainties cloud the FX outlook? Concentrate on the medium term and rely on the fundamentals, say Yianos Kontopoulos (right) and Marcel Kasumovich, FX strategists at Merrill Lynch in New York

White-label trend takes root

LONDON -- The liquidity outsourcing industry is reaching a crucial stage in its development, according to bankers, vendors and analysts polled by FX Week .

Manila clamps down on ‘dollar hoarders’

MANILA -- Bangko Sentral ng Pilipinas, the Philippines central bank, last week imposed monetary and non-monetary sanctions on eight banks for violating FX laws.

White-label trend takes root

LONDON -- The liquidity outsourcing industry is reaching a crucial stage in its development, according to bankers, vendors and analysts polled by FX Week .