Post-trade

Dollar still top currency for central banks

LONDON – Market speculation that central banks began rebalancing their reserves away from the dollar last year was misled, according to the Bank for International Settlements’ (BIS) annual report released last week.

Fed cut boosts dollar, but doubts remain

WASHINGTON, DC -- The Federal Reserve’s 25 basis point interest rate cut last week did little to excite the FX markets, and analysts said the US currency could be entering a period of consolidation.

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto

Politics mars eastern European FX process

BUDAPEST -- Political interference in Hungary’s monetary policy decisions could ultimately damage regional currencies and derail the accession process to the eurozone, analysts told FX Week .

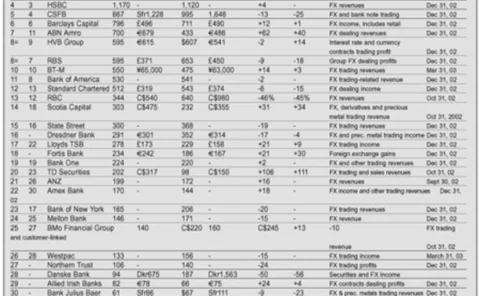

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Yen drives fund gains

STAMFORD, CT -- Movements in Japanese yen helped nearly 75% of currency managers on the Parker FX Index to record positive returns in April, while the index itself was up 0.9%.

Cashflow control for pension portfolio hedges

Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency Management, offers a solution to an FX-related problem facing a UK pension fund

Rand recovery spells good news for South African FX

JOHANNESBURG -- The dramatic recovery of the rand and surging international interest in South Africa have proved a money-maker for local banks, market participants told FX Week .

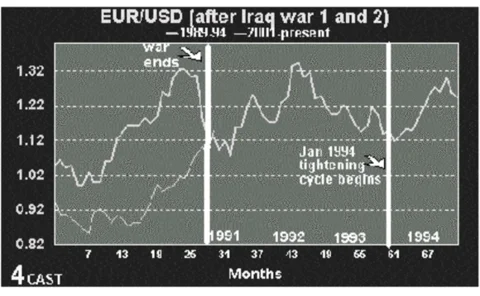

The George Jnr-George Snr divergence trade

George Bush Snr and Jnr’s presidential terms have been separated by nearly a decade. But, says Alan Ruskin, research director at 4Cast in New York, the economics on the surface look startlingly similar

Saxo Bank’s forex fund flourishes online

COPENHAGEN -- Saxo Bank’s managed FX fund has produced returns of over 3% so far this year, despite the war in Iraq and the geopolitical uncertainty that marked Q1. Saxo’s 3.08% return tops the aggregated performance of the 49 currency funds on the…

Isda adds 4pm fixing time for HK$

HONG KONG -- The International Swaps and Derivatives Association (Isda) has added a 4pm fixing time to its Hong Kong dollar IsdaFix swap rate service. That adds to the daily 11am fixing in the Hong Kong dollar. Both the 11am and 4pm Hong Kong dollar…

EBS prime brokers unveiled

LONDON – Deutsche Bank, JP Morgan Chase (JPMC) and Royal Bank of Scotland (RBS) will be the first prime brokers on a new interbank prime brokerage service from spot broker EBS.

Market rounds on dollar as US doubts gather

NEW YORK -- The dollar sagged to a four-year low against the euro last week, and fell across the board.

Indian market opens up

MUMBAI -- Reform of India’s FX rules could create the next large emerging market, signalling a lucrative new area for banks to exploit.

Chinese derivatives regulations expected soon

SHANGHAI -- The Chinese central bank is expected to publish new regulations within the next few months aimed at easing tough restrictions in the country’s forex derivatives market, say bankers.

A firm view on the rand

Unexpected data revealing South Africa’s current account surplus has led Merrill Lynch to cite a firm view on the rand. Jos Gerson, chief economist for South Africa in Cape Town, explains key factors that must be taken into account in coming to a solution

More prime brokers take to web

LONDON -- Automation of the prime brokerage industry is well underway, with a host of new services set to hit the market in the coming months.

Dollar consolidation brings FX manager joy

STAMFORD, CT -- A temporary halt in the US dollar’s downtrend helped 60% of currency managers on the Parker FX Index maintain positive returns in February. But returns were limited -- the index was up just 0.16% for the month.

Trading practices yet to change post-CLS

NEW YORK -- Banks are reporting little change in the way they trade as a result of using the new continuous-linked settlement (CLS) service, according to an official survey out this week.

Electronic options broking to rise

LONDON -- Electronic broking of FX options is set to rise over the next 12 months, finds new research out this week.

Market suspects yen intervention

TOKYO -- Speculation was rife in FX markets last week that the Bank of Japan was intervening to attempt to keep the yen above 120 per dollar ahead of the Japanese fiscal year-end today (March 31).

Tech glitch strikes CLS

NEW YORK -- The failed settlement of over 20,000 Australian dollar and Japanese yen trades on the Continuous Linked Settlement (CLS) service last week was caused by multiple technical faults, senior CLS officials told FX Week .