Trading

Japan steps up yen intervention battle

TOKYO -- Japanese authorities intervened in the forex markets again last week as the yen came under more pressure from the weakening dollar.

Bank of Japan intervention set to continue

TOKYO – Japanese authorities spent over $20 billion in the forex markets in Q1 this year, in an effort to ease the yen’s strength against the dollar and the euro.

Intesa bows out of London

LONDON – Banca Intesa, one of the last Italian banks still trading FX in London, closed its desk in April, becoming the latest of its compatriots to consolidate forex in Italy.

US judge dismisses Gain Capital law suit

WARREN, NJ – A lawsuit filed in New York against online forex dealer Gain Capital was dismissed last month.

EBS prime brokers unveiled

LONDON – Deutsche Bank, JP Morgan Chase (JPMC) and Royal Bank of Scotland (RBS) will be the first prime brokers on a new interbank prime brokerage service from spot broker EBS.

You have the right to remain bullish

Indonesia’s currency has offered arresting yields, while the Singapore dollar is supported by its powerful monetary authority. Further gains in both are likely, say Standard Chartered’s Claudio Piron and Marios Maratheftis.

European banks under euro threat

FRANKFURT – Major European banks’ half-year FX earnings could be under threat from the rise of the euro, senior market participants told FX Week .

Market eyes new euro/dollar high

LONDON – A lifetime high for the euro against the dollar became a distinct possibility last week as the greenback continued to crumble across the board.

Step right up for Aussie risk hedging

Fears of Australian dollar volatility could be laid to rest by a step payment option, say Paul Rhodes and Gail Sheridan, financial engineers at UBS Warburg in London.

HK launches euro clearing system

HONG KONG -- Hong Kong went live with a new euro clearing system last week, in an effort to reduce FX settlement risk in the Asian timezone.

Market rounds on dollar as US doubts gather

NEW YORK -- The dollar sagged to a four-year low against the euro last week, and fell across the board.

The leveraged reverse knock-in forward

With the recent strengthening of the Canadian dollar against the US dollar, a Canadian exporter with US receivables would be wise to consider a reverse knock-in forward, says Richard Stang, vice-president in FX sales at TD Securities in Toronto

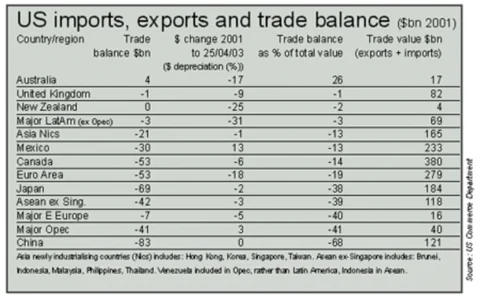

Falling dollar, limited external adjustment

Issues surrounding capital flows and surpluses could lead to some countries reconsidering their currency pegs, says Steven Englander (right), chief currency strategist, Americas, at Barclays Capital in New York

Misys buys Crossmar

NEW YORK -- UK systems provider Misys has bought the Crossmar Matching Service (CMS), a foreign exchange and money market confirmation matching service, from Citicorp’s subsidiary Crossmar for $13 million in cash.

BoA links major and emerging FX forwards in risk strategy drive

LONDON -- Bank of America (BoA) has merged its forwards and emerging markets forwards businesses in London, and hired three forwards traders globally as part of a continued drive to move to a strategic risk management model, a senior official told FX…

ACI UK annual ball raises over £46,000

LONDON -- Forex industry body the ACI’s UK branch last week said it had raised £46,300 at its annual ball held at the Grosvenor House hotel in London on April 25.

Indian market opens up

MUMBAI -- Reform of India’s FX rules could create the next large emerging market, signalling a lucrative new area for banks to exploit.

Plimsoll steps into currency overlay

NEW JERSEY -- Summit, New Jersey-based fund manager Plimsoll Capital is moving into currency overlay, and expects to secure its first clients this quarter, a senior official told FX Week .

IMF outlines reserve currencies criteria

WASHINGTON -- The currency composition of a central bank’s reserves is not an easy decision to make, according to a collection of case studies compiled by the International Monetary Fund (IMF).

Chinese derivatives regulations expected soon

SHANGHAI -- The Chinese central bank is expected to publish new regulations within the next few months aimed at easing tough restrictions in the country’s forex derivatives market, say bankers.

Cycles, structures and the dollar

It is difficult to ascertain what drives the capital markets at any one time. Market participants often seem to confuse cyclical and structural factors, and this is especially true of the dollar now, says Marc Chandler, chief currency strategist at HSBC…