Foreign exchange

The American double-accrual forward

With expected further euro appreciation, EUR/USD forwards are trading at a premium. Here, Anna Leung, head of corporate treasury marketing at HSBC, shows a way to get access to future hedging at a lower cost

Deutsche cuts global forex

FRANKFURT & SINGAPORE -- Deutsche Bank is understood to be in the process of a major restructuring of its foreign exchange capabilities around the world.

NAB annual results sees FX slip into the red

MELBOURNE -- National Australia Bank recorded a loss in its forex business and a fall in income from forex derivatives trading, in its full-year results released this month.

Refco relaunches e-platform

NEW YORK -- Refco Group, the New York-based brokerage, has updated its e-FX trading platform.

Dresdner joins cutting queue

FRANKFURT/NEW YORK – The future for FX staff at Dresdner Kleinwort Wasserstein (DrKW) looks bleak as the bank makes major job cuts on a global scale.

CLS below half of FX activity

LONDON – CLS lacks traction outside the major banks and still accounts for far less than half of all FX transactions, according to a report by the Bank of England published this week.

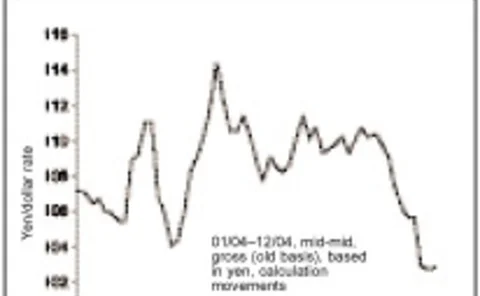

Conservative approach to further dollar weakness

A one-year 'leveraged ratchet forward' may help hedgers looking for a conservative strategy who are expecting a lower EUR/USD next year, say Eric Ohayon, European head of FX structuring, and Chris Weiss, FX structurer, at Bank of America in London

EBS signs up more prime banks

LONDON – EBS has signed agreements with nine more institutions enabling them to become prime banks, bringing the total to 16. The new banks on EBS Prime are: ABN Amro, AIG, Bank of America, Bear Stearns, Citigroup, Credit Suisse, UBS, Lehman Brothers and…

Opec turns its back on dollar

BASEL – Opec members have been reducing US dollar exposure in favour of the euro over the past three years, according to statistics released by the Bank for International Settlement (BIS) last week.

Dollar/won move boosts options market activity

HONG KONG -- Volumes in the forex options markets have surged off the back of the rapid move in the dollar/won over recent weeks, say analysts.

UK's Hargreaves Lansdown launches onto forex market

BRISTOL -- A leading UK stockbroker and financial advice firm is to launch into the FX market, offering its 500,000 customers access to Saxo Bank's rates.

BTM lead in Japanese forex slipping

TOKYO -- Bank of Tokyo-Mitsubishi (BTM) remains the top Japanese foreign exchange house in the country, with revenues for the first half of the Japanese fiscal year ending September 30 totalling ¥36.1 billion.

Forex liquidity crisis looms

LONDON – Top banks UBS, Deutsche Bank and Barclays Capital warned of a potential liquidity crisis in foreign exchange at the FX Week 2004 Congress in London last week.

Dynamic hedging strategies in Turkish lira

Emerging markets options offer the benefit of extreme differences in implied volatility and interest rate differentials. Here, James Davison, FX derivatives marketer at ABN Amro in London, outlines how corporate clients can see the benefits investors…

Forex appeal set to continue

Foreign exchange is likely to continue to appeal to investors as an asset class, as a result of its liquid and transparent markets and the trading opportunities it offers, said Daniel Szor, managing director of currency firm FX Concepts in Paris.

CME expects prop trading growth

The changing shape of the FX market and of the world economy will lead to significant changes in the way foreign exchange is traded.

China eases capital outflow restrictions

HONG KONG – authorities have taken further steps that should allow greater flows in foreign exchange trading over the coming months.

Commerzbank "exits London"

LONDON – Commerzbank is to close its trading and sales forex operations in London.

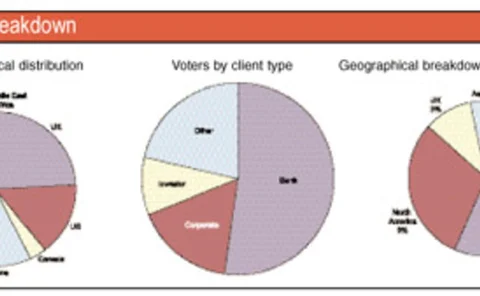

UBS holds onto pole position

LONDON – UBS is the top-rated bank in FX, according to the 1400 voters in FX Week's 10th annual survey of the market.

Slow start for India's retail FX market

MUMBAI – Nine months after retail investors were given the de facto go-ahead to start forex trading overseas, volumes have been subdued, say analysts.

UBS holds onto pole position

LONDON – UBS is the top-rated bank in FX, according to the 1400 voters in FX Week's 10th annual survey of the market.

Concerted intervention ruled out

FRANKFURT – Despite increasingly vigorous comments from European politicians arguing in favour of stemming the onward rise of the euro, concerted intervention from Europe and the US is extremely unlikely.

Investors invited to scale up overlay in Asia

HONG KONG – Investors in Asia could scale up the returns they are currently getting from FX overlay by investing in hedge funds, delegates at the ABN Amro Asia currency conference heard last week.