Europe

Banks offer crypto clearing but, shhh, don’t tell

Top dealers clear crypto futures for select clients despite smorgasbord of risks

Saxo Bank: Lagarde may declare monetary policy overreached limits

In one of its ‘outrageous predictions’ for 2020, the Danish bank says the ECB may wake up to the sad reality of negative interest rates

Euro/dollar crosses embrace RFRs, while other currencies lag

€STR becomes new standard for euro cross-currency swaps; CAD and AUD stick with legacy rates

The post-trade revolution: transforming the ability to manage liquidity and risk

Alex Knight, head of Europe, the Middle East and Africa at Baton Systems, explores the ongoing technological revolution in post-trade processing that consigns the problems of inefficient, costly and restrictive processes to the past

State Street launches tri-party custody for IM clients

Third-party provider begins shifting phase five clients to full-service collateral model

Phase five margin queues spur calls for custody revamp

Custodians urged to update “antiquated technology” ahead of threefold jump in phase six initial margin onboarding

Swedish central bank considers joining Target2 and T2S

Sveriges Riksbank says Eurosystem platforms could enhance policy but has security concerns

Dealers back CLS plans for EM settlement system

12 banks announce support for project to extend PvP protection to certain CLS-ineligible currencies

Capitolis to acquire LMRKTS

Deal for multilateral compression provider latest in wave of post-trade tie-ups, as SA-CCR bites

Quantum trading and the search for the perfect clock

Government push to overhaul satellite technology could improve time-stamping accuracy for trading firms – and for regulators

Simm template to be expanded for SA-CCR and FRTB

Crif-plus will capture risk exposures for all instruments, boosting optimisation potential

Esma plan ‘won’t help’ fix Mifid swaps data problem

Dealers say proposal to force disclosure of all big-bank OTC derivatives trades won’t improve data

Bloomberg’s new data retention policy vexes buy-side firms

Impacted users will have to pay extra to retain communications data for longer than two years

BoE and Treasury launch CBDC task force

Central bank also forms new division to lead “internal exploration” of digital currency

ECB’s digital euro consultation reveals public’s privacy fears

Nearly half of responses to ECB come from Germany

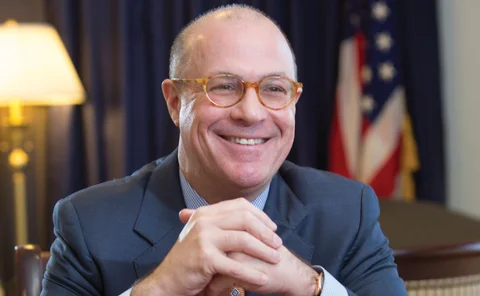

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

Former CFTC chair says managing collateral by distributed ledger technology would enable better oversight of risks

‘Do no harm’: central bankers warn against rush to issue CBDC

Agustín Carstens, Jerome Powell and Jens Weidmann highlight risks of acting too fast

EU’s initial margin relief may come too late for phase five

Long-awaited easing of model governance requirements unlikely to take effect by September

ECB pushes for greater crypto asset powers

Central bank suggests changes to afford it greater oversight of e-money issuers

Optimisation firms prep for SA-CCR boom

FX expected to be big focus of industry’s new slimming drive – and vendors are jockeying for position

All roads lead to Bergamo: Euronext eyes new home for its tech

Market participants fear a “horrible” relocation project and more room for latency arbitrage

Has Covid stopped the clocks on FX timestamp efforts?

Budget reallocation may not be the only factor stalling standardisation progress, say participants

Ulrich Bindseil on the launch of the digital euro

The ECB’s director-general for market infrastructure and payments speaks about the functionality, tiering approaches, privacy policies, ledger technology and ecosystem impact of the eurozone's planned CBDC

Optiver becomes first non-bank options market-maker on FXall

Dutch e-trading firm joins OTC FX options platform in a market taking electronic baby steps