Europe

FX Week Europe: Disaster in the eurozone still plausible, warns Neil Record

Founder of Record Currency Management favours a new type of hedging product that protects investors from the exit of eurozone members

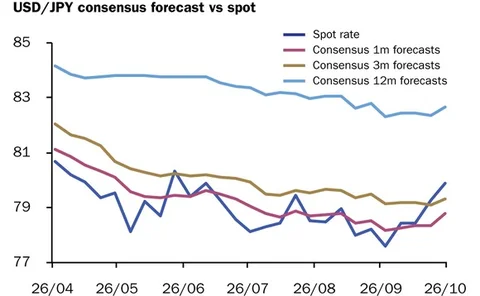

Yen will continue to weaken under BoJ pressure, says Nomura

An accurate prediction that the yen would weaken as a result of the Bank of Japan's monetary policy lands Nomura at the top of the one-month forecast rankings

Euro will weather the storm, says Natixis economist

Germany will not allow the euro to fail, which is why the currency is performing better than expected, according to Asia economist at Natixis

VIDEO: Saxo Bank G-10 Currency Market Outlook

An overview of currency markets into the fourth quarter and new year

Deutsche Ceemea sales head departs

18-year veteran of Deutsche Bank will leave in late October, after completing a handover to his successor

Grexit bets intensify on election fears

Forex strategists remain divided on the political fallout from landmark Greek elections, and the likely effect on the euro

Euro exit testing intensifies

Banks and FX market infrastructures are stepping up their efforts to prepare for a possible redenomination of eurozone currencies if Greece is forced to leave the currency union, but some investors would like to see new contracts to protect them from…

Moving up from down under

Following his recent appointment as global head of FX at Commonwealth Bank of Australia, Kieran Salter talks to Robert Mackenzie Smith about his mission to ensure the bank’s FX capabilities are globally recognised, and the major technology overhaul the…

Global inconsistency remains a challenge for would-be Sefs

An ongoing lack of clarity and the potential for extraterritoriality in swap execution facility rules is creating a bumpy ride towards registration, according to three putative Sefs

UBS beefs up FX sales team in Europe

The Swiss bank has made three appointments to its FX sales teams in London and Zurich

Forex markets absorb political chaos in Europe

Participants reacted relatively calmly to political developments in Europe last week, and the absence of credible alternative currencies prevented a major sell-off

Corporate treasurers plan for euro break-up

The Association of Corporate Treasurers is advising its members to review their processes and contracts to make sure they are prepared for a euro breakup. Many are taking the association's advice, reports Chiara Albanese

Cyprus becomes latest stop in Saxo’s global expansion

Saxo Bank is continuing its move into new markets with the opening of a Cyprus office today, headed up by Vitali Butbaev

Barclays hires former RBS FX sales head

Lisa Francis, Royal Bank of Scotland’s former head of FX sales for the UK and northern Europe, is due to join Barclays later this year

Testing euro exit scenarios

London-based think tank Policy Exchange is now judging the entries to the Wolfson Economics Prize, which asked entrants to propose the best way for a country to leave the eurozone. Following the relatively mild impact of Greece’s default earlier this…

Euro crisis could cause full EU break-up, warns ex-BoE official

John Gieve, former deputy governor for financial stability at the Bank of England, warns of an "explosion" waiting to happen in the EU

Euro sentiment turns upbeat after Greek deal

Politicians and strategists are cautiously optimistic on the euro, despite the considerable challenges that might lie ahead

FX Week Europe: Eurozone survival discussion is premature, says academic

European leaders are "playing poker", but the game will last longer than a few days, says Brunel University's professor of economics

The eurozone is not 'Hotel California', says BNY Mellon strategist

Simon Derrick stresses eurozone membership is not interminable and believes the likelihood of Greece leaving the eurozone is now the most plausible option following the events of last week

Audio: To QE or not to QE, is the only question?

Markets could be sleepwalking into global crisis 2.0 as a third round of quantitative easing becomes increasingly likely, cautions Nick Beecroft, senior markets consultant at Saxo Bank in London.

The euro: Up or down?

Nearly a year after the eurozone sovereign debt crisis erupted, we talk to four currency strategists to ascertain the prospects for the European currency over the coming year and identify the euro bears and bulls

UBS restructures European forex sales

UBS has strengthened its sales offering with a key hire amid an overhaul of its European sales structure.

HSBC ahead of the game with EM-to-EM focus

HSBC has maintained its lead in emerging market (EM) currencies by adapting its business to focus on the rise in trade between emerging market economies. But the trend sees EM-focused Standard Chartered hot on its heels.

Critics hit back at cross-border bank levy

Critics are hitting back at plans to introduce a bank levy on UK dealers, highlighting the challenges of implementing the cross-border charge.