Infrastructure

Russian derivatives legislation stalls

MOSCOW – Efforts to fast-track the introduction of new legislation in Russia to provide legal certainty for derivatives contracts appear to have failed since a hearing on the subject at the Russian Federation state duma on September 27.

Prime brokerage best for individual investors

Individuals who want to trade FX may find a prime broker will promote confidentiality, cut out settlement difficulties and help resolve credit issues, says Peter Wakefield, MD of research and product development at Record Currency Management in the UK

Canadians join State Street's e-commerce settlement service

BOSTON – State Street Global Markets signed up the big five Canadian banks to its settlement and confirmation matching tool for FX last week.

Shock job losses at Tullett

Tullett Liberty's forwards desk loses as merger with Prebon completes LONDON – Tullett Liberty has suffered a surprise defeat in the integration of its forex business with that of rival Prebon Yamane. Broking sources in London say Tullett's FX forwards…

US banks hit by flat trading

New York – Poor market conditions have led to a sharp fall-off in FX revenues for some US banks, but others managed to post increased returns in the third quarter.

SIBOS 2004

CLS rules the roost at Sibos

Indian forex settlement service joins CLS

MUMBAI – Indian FX settlement service the Clearing Corporation of India (CCIL) will go live on CLS on October 23.

US banks hit by flat trading

New York – Poor market conditions have led to a sharp fall-off in FX revenues for some US banks, but others managed to post increased returns in the third quarter.

Special Feature - CLS settlement: the next two years

As CLS enters its third year, Joseph De Feo discusses plans for expansion Two years ago, the CLS Group launched the world's first global settlement service for foreign exchange trades. Following several other aborted efforts to tackle Herstatt, or…

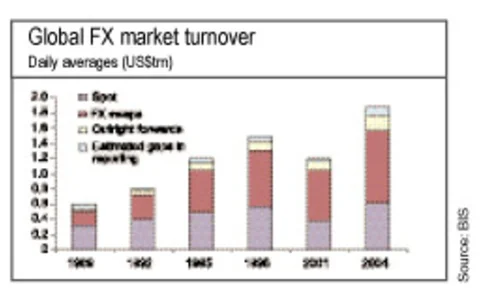

BIS paints bright future for FX

BASEL – The huge growth in daily turnover in the global foreign exchange market, revealed in the Bank for International Settlements’ (BIS) triennial FX survey last week, has painted a bright future ahead for forex market participants.

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

Making the most of upcoming volatility

For the currency overlay manager looking to take advantage of a burst of market volatility at the start of the fourth quarter, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their…

Optimism ahead of latest BIS FX trade figures

BASEL – Banks are bullish about the Bank of International Settlements' (BIS) latest FX trading figures, due out in a survey this week.

Citi reorgs senior management

LONDON – Citigroup has set up a new products and services group for foreign exchange, as part of a sweeping reorganisation of senior management.

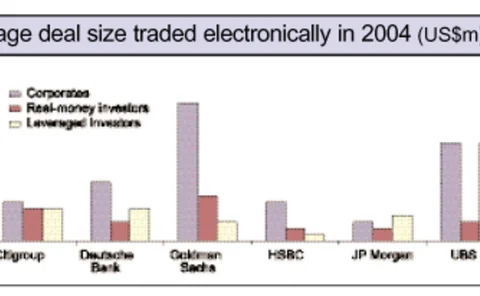

Average forex e-trade sizes on the rise

LONDON – The size of the average electronic FX trade is going up for corporates and real-money investors – but not in the leveraged sector of the industry, according to new research from UK consultancy ClientKnowledge.

NAB to re-open options desk

MELBOURNE – National Australia Bank hopes to re-open its currency options desk in the "near-term", said chairman Graham Kraehe last week. However, the bank refused to be drawn on a date, saying it was up to regulator the Australian Prudential Regulation…

South Africa comes under global focus

JOHANNESBURG – South Africa is currently a focus of activity in the FX world, as global institutions such as the Continuous-Linked Settlement Group (CLS) and spot broker EBS add the region to their sphere of activity.

FX volumes up by a third

LONDON – FX trading volumes are up by nearly a third over the past three years, according to new research from UK consultancy ClientKnowledge.

CSAM to add emerging markets to FX management

LONDON – Credit Suisse Asset Management (CSAM) is looking to add emerging market currencies to its suite of forex management services from early next year.

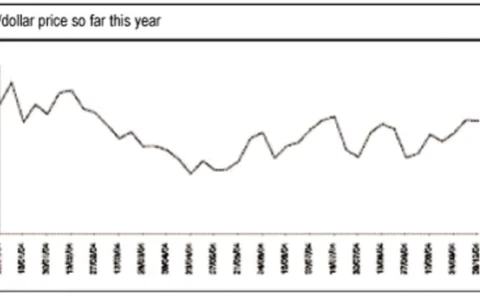

Dollar/yen break-out expected

TOKYO – Technical indicators suggest dollar/yen could be set to break out of the tight trading range it has been trapped in since June. "Resistance is declining and support is rising. We will get a decent break-out trade soon," said Karen Griffith, head…

Oil price hits Asian currencies

HONG KONG – Surging oil prices have put pressure on Asian currencies, but the impact has been magnified by other factors influencing the region, according to analysts.

Toyota reports ¥70bn FX impact

TOKYO – Japanese car manufacturer Toyota Motor Corporation last week announced a ¥70 billion ($645 million) hit from exchange rate changes affecting its first quarter operating income.

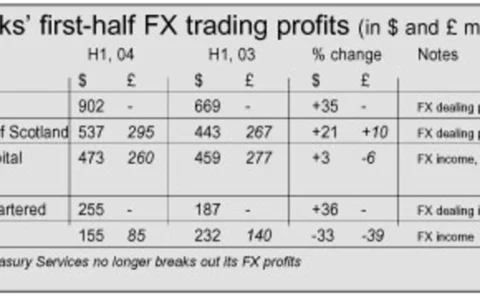

HSBC’s profits up by a third

LONDON – HSBC’s FX profits so far this year are up by more than a third compared with last year, with a massive $902 million earned from FX dealing in the first half.