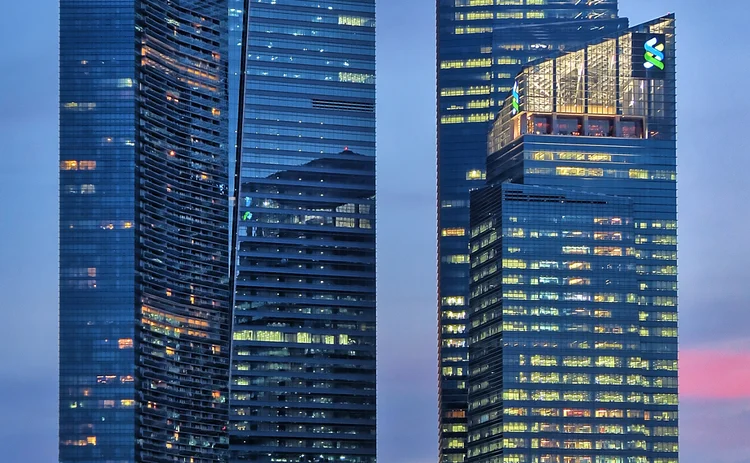

StanChart’s e-FX trading engine goes live in Singapore

Trade latency has been cut by more than 80%, Standard Chartered says

Standard Chartered has executed the first trade using its electronic foreign exchange trading engine in Singapore, achieving a reduction in trade latency of more than 80%, the bank said on January 22.

The trade, conducted on January 20 in Singapore, was with Standard Chartered’s counterparty, United Overseas Bank.

Standard Chartered previously said it would set up an electronic currency pricing and trading engine in Singapore, after Citi and UBS announced plans to do so last year.

JP Morgan

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@fx-markets.com or view our subscription options here: https://subscriptions.fx-markets.com

You are currently unable to print this content. Please contact info@fx-markets.com to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Trading

Wild dollar swing upended FX options hedges

Banks chased vol higher as last week’s EUR/USD surge knocked out barrier trades

Will lifer exodus kill Taiwan’s NDF market?

Traders split over whether insurers’ retreat from FX hedging is help or hindrance

LatAm FX carry trade shrugs off geopolitical fears

Clients in regional carry positions remain undeterred by US interventions, say dealers

US mutual funds slash short euro positions at record pace

Counterparty Radar: Pimco cut $4.6bn of EUR/USD puts in Q3 amid changing stance on dollar direction

Nomura hires new global eFX head

Mark McMillan to oversee e-trading and sales activities in newly created role

Trump’s LatAm gambit spurs FX hedging rush

Venezuela op boosts risk reversals as investors look to protect carry trades

Review of 2025: A topsy-turvy ride

Rollercoaster year for FX traders ends with G10 volatility and hedging flows back where they started

US insurers turn to short-dated FX forwards as notionals rise

Counterparty Radar: Trades under three months make up nearly 60% of total positions, up from just a third in 2022