Morgan Stanley: inverted swap spreads will alter pension fund hedging

The UK 30-year gilt rate has been higher than its swap equivilant since mid-2008 and while the spread has shrunk from its 150-basis-point peak it still stands at about 50bp, according to data from Morgan Stanley. This is a reversal of pre-crisis market norms and inverted spreads are generally regarded as anomalous due to the lower credit risk associated with government debt.

But Laurence Mutkin, senior European interest rate strategist at Morgan Stanley, disagrees. He argued inverted spreads

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@fx-markets.com or view our subscription options here: https://subscriptions.fx-markets.com

You are currently unable to print this content. Please contact info@fx-markets.com to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Asset Liability Management

FX risk worries grow for US pension funds

Currency risks have risen on the list of priorities for pension funds amid fears of future negative cashflow

Solutions to rouble trouble

The rouble derivatives market developed in haste after further liberalisation of the currency in July 2006 and positive changes to the Russian Civil Code 1062, centring around the previous treatment of derivatives as gaming, in January 2007.

When volatile waters grow calmer

REAL-LIFE PROBLEMS, INNOVATIVE SOLUTIONS

How to play gravity-defying USD/JPY

REAL-LIFE PROBLEMS, INNOVATIVE SOLUTIONS

Diversifying through Africa

REAL-LIFE PROBLEMS, INNOVATIVE SOLUTIONS

Heading for the final USD selling opportunity

Hans-Guenther Redeker, global head of FX strategy at BNP Paribas in London, suggests a way to take advantage of the prospect of near-term dollar strength to protect against the likelihood of longer-term USD weakness.

Asian currencies at risk from oil surge

JAKARTA – Asian currencies have taken a hit from surging oil prices, which remained above $60 last week despite falling off record levels set earlier this month.

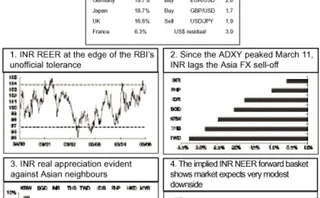

INR – everything is relative

The INR’s over-extended valuation against the Reserve Bank of India’s REER implicit policy anchor continues. This over-extension is looking anomalous against the continued backdrop of Asian FX selling. Claudio Piron, Asian FX strategist at JP Morgan in…