e-FX Achievement of the Year: Jon Vollemaere

From Reuters D22 to R5FX via Currenex, Vollemaere gains recognition for a career in e-commerce

Jon Vollemaere started his career in foreign exchange at a time when electronic trading was little more than a vision of the future, in 1992. Voice trading being the norm at the time, Vollemaere's involvement with the then nascent Reuters D22 dealing platform, the first e-FX venue, was the sign of things to come as the young twenty-something generation entered the ranks of currency trading via what was to become the e-commerce world.

"I've been involved with e-FX from the start," says Vollemaere, who won the 2016 FX Week e-FX Achievement of the Year award.

"My first proper job was on Reuters D22 Matching, which really was the first e-FX service – well before the term e-commerce came along a few years later. It was a great team of people, many of them still in the business, and we had a lot of fun. It was the pre-internet, pre-email age when Uber was just a German adjective," he says.

Currenex really was the first multi-bank ECN and we had to convince the banks to use it, which was initially very hard

Jon Vollemaere, R5FX

After leaving Reuters, Vollemaere joined Currenex, a start-up founded in 1999, as part of the original team that paved the way for the first multi-bank ECN to gain market share, eventually being sold to State Street for $564 million in cash in 2007.

"Currenex really was the first multi-bank ECN and we had to convince the banks to use it, which was initially very hard," he recalls.

This pattern of trying to convince market participants to look at future trends and prepare for them remained with Vollemaere throughout his career.

"After Currenex, I spent my time telling banks that paying attention to retail flow was a good idea, and later that social media, low latency and HFT were all something that were going to change the status quo," he says.

Vollemaere's roles included stints at FXCM and Barclays, before co-founding and building-out global low-latency network FXecosystem, followed by the establishment of retail FX trading community LetsTalkFX.

Emerging markets

In 2011, he realised regulation would make it exceptionally difficult for emerging markets contracts, mainly non-deliverable forwards (NDF), to continue trading in the traditional voice-driven manner, as costs for dealers were set to rise exponentially. So he developed a central-credit component for the first electronic, multi-dealer NDF-trading platform, R5FX.

"Now I spend my day telling banks they should pay attention to China, India and central credit," Vollemaere continues.

Since his first days in the market, the industry has fundamentally changed, with transparency hitting margins, making it increasingly important to manage flows and get technological requirements right.

"Ultimately, the customer has got a better deal and the market-makers have had to process more deals at lower margins," Vollemaere says. "But I guess the biggest change is the noise levels on the trading floors. Most of the time it's just so quiet now."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@fx-markets.com or view our subscription options here: https://subscriptions.fx-markets.com

You are currently unable to print this content. Please contact info@fx-markets.com to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Emerging Markets

The EM units to watch as US and China make peace – Swissquote

Currencies such as the Thai baht, which trades heavily with China, should benefit from easing tensions

US sanctions on Venezuela could spell end of petro

Crypto asset is backed by oil reserves the country can barely commercialise

Jamaica uses social media to calm markets after FX intervention

Central bank's Wynter says FX volatility is nothing to worry about, but makes veiled warning

Lebanese pound finds support in newfound political unity

As new government forms, investors are more willing to sell dollars and buy Lebanon’s currency

Investors eye Mexico and Brazil amid hopes in regime change

They believe a projected weakening in the dollar will support emerging markets

ACI partners ICA to promote FX Global Code in Mena

Financial market association joins forces with Interarab Cambist Association

Edgewater launches Latam FX venue

LatamFX.Pro will aid price discovery in the Mexican, Chilean, Colombian and Argentine peso, the Brazilian real and Peruvian sol

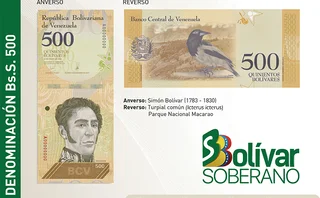

Venezuela launches app for FX conversion

App allows members of the public to convert prices into the new bolivar soberano