Mattias Palm, head of triReduce FX at TriOptima, explores the findings of a study comparing capital costs under the current exposure model (CEM) with the standardised approach to counterparty credit risk (SA-CCR)

The introduction of the new capital regulation, SA-CCR, drastically changes the metrics used for deriving capital cost. For many years, under CEM, capital costs have largely been driven by the total gross notional. Under SA-CCR, this shifts to using risk-based counterparty exposure instead. This is a fundamental change of methodology, which could have a huge impact on trading behaviour, as well as post-trade portfolio optimisation.

The FX market differs from the rest of the financial markets in that it largely remains outside of the bilateral initial margin (IM) requirements introduced with the uncleared margin rules (UMR) a few years ago. Physically settled FX trades are exempt from UMR and thus do not attract any of the costs associated with funding bilateral IM for market participants.

To analyse how the industry could mitigate the cost of holding capital on balance sheets under SA-CCR, TriOptima conducted a study based on the trade population between the 20 largest banks in the seven largest currency pairs. This study calculated the capital costs under CEM and compared them with those under SA-CCR.

The first conclusion from the study was that the capital cost for the industry remained largely unchanged under the two regulations. For some banks, the cost was lower under SA-CCR and for others it was higher. In other words, there does not appear to be any automatic capital cost rebate as a result of SA-CCR.

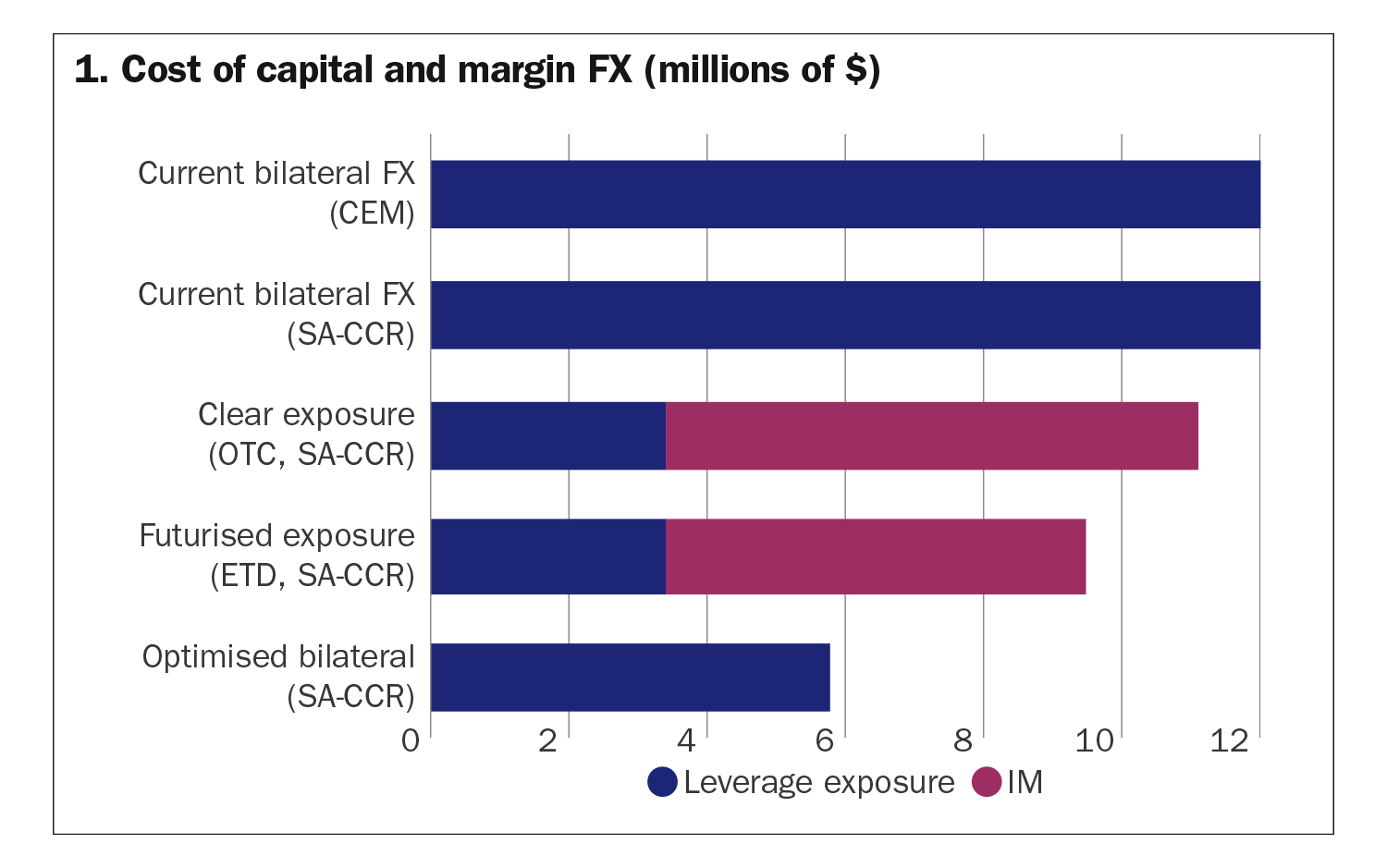

TriOptima then analysed the potential for reducing the bilateral exposures through different methods, with the goal of reducing the capital cost under SA-CCR. The greatest reduction of capital costs would be achieved through futurisation of the trades – in effect, converting over-the-counter (OTC) exposures into exchange-traded derivatives – or through clearing the OTC forwards. The study showed that either option would cut capital cost by at least two-thirds. However, in both cases, the trades would switch from being unmargined – as FX forwards are not subject to UMR – to margined trades. Incurring the additional IM expense would drastically limit the savings made when looking at the all-in cost.

The third alternative is to keep the FX forwards bilateral, but optimised multilaterally. This means bilateral delta exposure is redistributed between counterparties to minimise the total counterparty risk – and thus their capital cost – for example, by moving an exposure facing one counterparty to face another where it offsets an outstanding risk, reducing the total exposure across both counterparties. The netting in this case is not quite as efficient as with clearing and futurisation, but residual exposures will remain bilateral and will not be subject to any additional cost of IM. That means the all-in cost of the portfolio would be significantly lower compared with the other two options.

The results of the different alternatives are highlighted in figure 1.

Different market participants have different objectives based on their portfolio structures, IT infrastructures, and so on, and we will likely see a combination of different methods for tackling the new reality under SA-CCR – as has historically been the case when capital regulations change. Some will use OTC clearing because it is the best fit, while others will use futures. However, our conclusion is that we are not likely to see a mass exodus from bilateral OTC trading in FX forwards since the economic incentive is simply not there.

Even in the case of FX non-deliverable forwards – which, unlike FX forwards, are bilaterally margined – the cleared volume falls well short of the total volume. Operational constraints, particularly in the prime broker space, have, to a significant degree, prevented trades from being cleared.

Balancing exposures

To efficiently manage post-trade optimisation of their FX portfolios, market participants need to consider both the exposure under SA-CCR and under UMR. Thus, any post-trade optimisation model that takes SA-CCR and UMR into account would seek to minimise both the total FX exposure and the FX exposure in scope for UMR.

In addition, there are several other metrics that incur different costs, including risk-weighted assets, gross notional outstanding, balance sheet usage, and so on. If different metrics are managed and optimised in separate processes, it can quickly lead to suboptimisation when the benefit of improving one metric is offset by increased costs from unintended changes in others. This means the optimisation model needs to be able to take multiple metrics into account simultaneously.

Furthermore, optimisation services that redistribute or rebalance risk within a network are based on the idea that injecting an offsetting hedge transaction into an existing trading relationship can reduce the outstanding risk and, over time, the cost of capital from, for example, SA-CCR. However, by also including the trade population available for compression, the reduction of bilateral exposures can also be achieved by terminating transactions that contribute to the existing bilateral exposures. Combined, terminations and new trades allow reduction of gross notional to be balanced against net exposure reduction. The process can therefore accommodate all types of participants, regardless of whether they are sensitive to gross notional or whether they can perform terminations.

More information on TriOptima’s SA-CCR optimisation solutions

Mattias Palm, head of triReduce FX, TriOptima

Mattias Palm has worked at TriOptima for 10 years and is responsible for managing FX compression and optimisation. Prior to joining TriOptima, Mattias worked in FX and commodities trading and risk management for companies such as Nasdaq OMX, Brady, PA Consulting Group and Capgemini. He holds a master of science degree in electrical engineering and computer science from the Royal Institute of Technology in Stockholm, Sweden.

All information contained herein (“Information”) is for informational purposes only, is confidential and is the intellectual property of CME Group Inc. and/or one of its group companies (“CME”). The Information is directed to equivalent counterparties and professional clients only and is not intended for non-professional clients (as defined in the Swedish Securities Market Law (lag (2007:528) om värdepappersmarknaden)) or equivalent in a relevant jurisdiction. This Information is not, and should not be construed as, an offer or solicitation to sell or buy any product, investment, security or any other financial instrument or to participate in any particular trading strategy. CME and the CME logo are trademarks of CME Group. TriOptima AB is regulated by the Swedish Financial Supervisory Authority for the reception and transmission of orders in relation to one or more financial instruments. TriOptima AB is registered with the US National Futures Association as an introducing broker. For further regulatory information, please see www.cmegroup.com. TriOptima holds a permit under Section 49A of the Israeli Securities Law, however, TriOptima’s operations are not subject to the supervision of the Israel Securities Authority. This permit does not constitute an opinion regarding the quality of the services rendered by the permit holder or the risks that such services entail. TriOptima’s services are designed exclusively for qualified investors in accordance with Israeli law. For further regulatory information, please see www.cmegroup.com.

TriOptima AB. Registered Address: Mäster Samuelsgatan 17, 111 44 Stockholm, Sweden

Org no.: 556584-9758

Copyright © 2021 CME Group Inc. All rights reserved.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com